Weekly Market Commentary January 10 2025

Canada Stocks Rally to Persist

It turned out to be a strong year for investors as the Canadian stock market finished the year on a high, despite coming under pressure in the last quarter. The main stock index, the Toronto Stock Exchange, closed the year up 18% after hitting record highs of about 25,800 and pulling back significantly. The stellar performance was driven mainly by gains in the commodities and technology sector.

Nevertheless, the market remains on edge at the start of the year, amid the political uncertainty with the resignation of Prime Minister Justin Trudeau. Likewise, the uncertainty over potential trade tariffs once Donald Trump assumes office on January 20 should continue piling pressure.

Amid the string of headwinds, expectations are high that the Canadian equity market will continue building strength from 2024. The uptick seems set to continue, given the favourable interest rate environment, with the Bank of Canada cutting, despite increasing volatility and the slow pace of gains. A resilient consumer with the lowering of interest rates, softening inflation levels, and rising wages should also work in favour of equity market gains in 2025.

Senior wealth manager of Velocity Investment Partners with Raymond James Ltd. Brianne Gardner expects rising corporate profits and earnings across the board to support the uptick in the equity market. An average 10% to 12% earnings growth should push the TSX higher. Strong commodity prices, particularly in the energy and materials sectors, which are expected to recover in 2025, are also expected to fuel the TSX's growth.

In an attempt to boost the number of homes in the upcoming years, the federal government recently increased its investments in Canadian infrastructure, which may contribute to the index's basic materials sector's recovery.

According to Gardner, a weakening Canadian dollar might also benefit the stock market by drawing in more foreign capital. Future mortgage renewals are anticipated to provide a modest boost to the Canadian financial sector, which has maintained a strong performance and is poised for future profitability.

On the other hand, gains in the Canadian equity market are expected to lag gains in the U.S. equity markets. This is a trend that was evident in 2024 when the S&P 500 ended the year up by 24% compared to 18% gains for the TSX. The much lower gains match Canada’s slower economic momentum ahead of trade and export uncertainties. However, the TSX could receive a significant boost in the year's second half and perform much better, as interest rates continue to decline.

The Markets

Hello, 2025!

As we head into a new year, it can be helpful to look back at the previous year—and 2024 was a doozy. Stocks in the United States delivered a double-double—posting double-digit gains for a second year in a row. That kind of performance is a relative rarity and has only occurred nine times over the last 96 years, according to Tony DeSpirito of BlackRock.

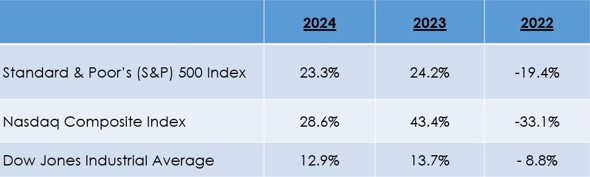

So, how well did U.S. stocks perform? Here are annual returns for major U.S. stock indexes over the past two years—plus the return for 2022 as a reminder that stocks don’t always move higher.

Throughout 2024, share price gains were supported by several factors, including:

- Enthusiasm for Artificial Intelligence (AI). Magnificent Seven stocks had another big year. “The group…averaged a gain of 65 [percent] this year, compared with an average of 111 [percent] last year, according to Dow Jones Market Data,” reported Emily Dattilo of Barron’s in December 2024. “The Mag 7 has made up 57 [percent] of the S&P 500’s…market [capitalization] gain this year versus 65 [percent] last year."

- Strong corporate revenue and earnings growth. Many publicly traded companies have been making more money and growing profits. For the full year 2024, analysts expect companies in the S&P 500 to report year over year earnings growth of 9.4% and revenue growth of 5.1%. In 2025, expectations are even higher. Earnings growth was forecast to be 14.8% and revenue growth 5.8% for the year, reported John Butters of FactSet.

- A solid U.S. economy. “Over the last few years, the U.S. economy has consistently defied expectations for a slowdown, and 2024 was no different. Despite uncertainty around a presidential election, elevated interest rates and a cooling labor market, economic growth remained solid this year,” reported Augusta Saraiva of Bloomberg.

- Steady consumer spending. A key driver for the economy was robust consumer spending. “Even as hiring slowed, wage growth continued to outpace inflation and household wealth reached new records, supporting an ongoing expansion in household spending,” wrote Saraiva.

- Anticipation of Federal Reserve rate cuts. For much of the year, investors eagerly anticipated Federal Reserve (Fed) rates. In general, when the Fed lowers the federal funds rate, borrowing becomes less expensive which can boost corporate earnings and share prices, explained Mary Hall of Investopedia.

These factors helped U.S. stocks repeatedly set new record highs during the final quarter of the year. However, the stock rally stalled in December after the Fed expressed concerns about inflation and modified its forecast for 2025 rate cuts “amid slower progress on inflation and an uncertain policy outlook,” reported Sarah Hansen and Bella Albrecht of Morningstar.

In the bond market, many sectors delivered positive returns over the full year 2024. However, quite a few gave back some gains in the last months of the year. “Bond markets saw a major selloff in the fourth quarter, sparked by the outcome of the U.S. presidential election and the potential for stronger economic growth, inflationary policies, and more deficit spending in the years ahead,” reported Hansen and Albrecht. The yield on the benchmark 10-year U.S. Treasury note started the year at 3.95% and finished the year at 4.58%.

Last week, which was shorter than usual due to the New Year’s holiday, major U.S. stock indices finished lower. The yield curve continued to steepen as yields on shorter maturities of U.S. Treasuries fell, while yields on longer maturities rose.

Source: FactSet

A BRRR-Y COLD NEW YEAR’S TRADITION. People around the world like to welcome the new year by putting on a bathing or wet suit and immersing themselves in cold water. The name of the event—Polar Bear Plunge, Christmas Swim, or New Year’s Dive—varies by location. Of course, water and air temperature vary greatly, too, depending on where the plunge takes place. Here are a few examples from the United States on January 1, 2025.

Coney Island, New York/Atlantic Ocean

Air temperature: 50.0 degrees Fahrenheit

Water temperature: 40.5 degrees Fahrenheit

Myrtle Beach, South Carolina/Atlantic Ocean

Air temperature: 60.0 degrees Fahrenheit

Water temperature: 58.4 degrees Fahrenheit

Milwaukee, Wisconsin/Lake Michigan

Air temperature: 30.0 degrees Fahrenheit

Water temperature: 39.7 degrees Fahrenheit

San Diego, California/Pacific Ocean

Air temperature: 60.0 degrees Fahrenheit

Water temperature: 57.1 degrees Fahrenheit

According to Cleveland Clinic Health Essentials, submerging yourself in cold water for short periods may have health benefits. For people who are in good health, cold-water baths may ease sore muscles, reduce inflammation, improve circulation, and promote better sleep. (It remains unclear whether New Year’s Day plunges confer any of these benefits.)

How did you celebrate the start of the new year?

Weekly Focus – Think About It

“Write it on your heart that every day is the best day in the year.”

—Ralph Waldo Emerson, philosopher

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.