Weekly Market Commentary February 13 2025

Canada’s Economic Future on Edge

Canada must have a plan for its economic future. That’s the sentiment echoed by economists at a time when the country faces the threat of a 25 per cent trade tariff from the U.S. Given that the country has struggled with growth and productivity for years, the issue could worsen, should U.S. President Donald Trump come through with the proposed 25 per cent tariff.

Following decades of free trade, the U.S. president's tariff threat to a C$1.3 trillion relationship has forced policymakers to consider how to reduce the nation's reliance on its southern neighbour and rebalance its economy.

"It's not business as usual. President Trump has made that very clear. The level of angst around where we go next is something I've never seen in all my years.… We cannot rest on our laurels or on the goodwill of others or what we've always done. We have to think again. We must be the architects of our own future,” said Calgary Chamber CEO Deborah Yedlin.

In a report, the Calgary Chamber of Commerce insists that businesses should be at the forefront of solving issues that have bedeviled the country to drive the economic agenda. The Chamber is also calling on the federal government to establish interprovincial trade corridors in order to lessen dependency on the United States for economic growth, as trade is a major concern for Canadians. According to Yedlin, that would have a big impact on small businesses.

More funding for minority-owned enterprises, closer collaboration with post-secondary educational institutions to bridge skills gaps, putting small business public safety first, and expanding Canada's oil refining capacity are among the Chamber's 82 recommendations.

The remarks come on Statistics Canada reiterating that rising rules and regulations shaved almost two per cent points off the growth in output from Canadian business over 15 years. Economist Wulong Gu found that regulations slowed the development of the business sector's GDP by 1.7 percentage points between 2006 and 2021. Additionally, regulations hindered business investment and limited the growth of labour productivity and employment by 0.4 and 1.3 percentage points, respectively, during the period.

The report comes as the federal and provincial governments consider ways to improve the nation's economic outlook in the face of U.S. threats to impose tariffs on Canadian goods, most recently steel and aluminium. Stephen Poloz, a former governor of the Bank of Canada, maintains that eliminating the disparate product and licensing requirements across the provinces, which cause business inefficiencies, would "completely offset" the economic effects of U.S. tariffs. Economists say the GDP could increase by 4–7 percentage points if interprovincial trade barriers were removed.

Meanwhile, Canada's labour market continues to grow at an impressive rate. The unemployment rate has dropped to 6.6 per cent from 7.7 per cent in January. The drop came as the economy added 76,000 jobs above the 25,000 job addition that analysts expected. Last month, the Bank of Canada stated that although the labour market was still weak, there were indications that its rate cuts were stimulating consumer spending and business activity.

Solid economic data is the latest catalyst steering the Canadian stock market to record highs. The country’s main stock index is inches away from record highs above 25,808, bolstered by significant gains in the technology and resources sectors. Additionally, investors' sentiments on equities have improved significantly, with Trump pausing trade tariffs for one month.

"We're still reasonably bullish on the TSX. We're cautiously optimistic that we're going to end up with a positive year - we're predicting 27,000 for the end of the year. But I think there's going to be a lot of volatility between now and then," said Jay Bala, co-founder and senior portfolio manager at AIP Asset Management.

The Markets

Optimism headed south on Friday.

After rising for most of the week, stock markets lost momentum last Friday as economic data raised doubts about further Federal Reserve rate cuts, reported Rita Nazareth of Bloomberg. Late in the day, President Trump announced new tariffs would be imposed this week, and stocks dropped into negative territory.

Consumer Sentiment Fell Sharply

Last week, the University of Michigan Consumer Sentiment Index reported that consumer confidence, which tumbled four per cent in January, fell another five per cent in February.

“Consumer sentiment fell for the second straight month, dropping about five [per cent] to reach its lowest reading since July 2024. The decrease was pervasive, with Republicans, Independents, and Democrats all posting sentiment declines from January, along with consumers across age and wealth groups. Furthermore, all five index components deteriorated this month, led by a 12 [per cent] slide in buying conditions for durables, in part due to a perception that it may be too late to avoid the negative impact of tariff policy. Expectations for personal finances sank about six [per cent] from last month, again seen across all political affiliations, reaching its lowest value since October 2023. Many consumers appear worried that high inflation will return within the next year,” wrote Surveys of Consumers Director Joanne Hsu.

Rising inflation could keep the Federal Reserve from lowering rates further. Survey participants expected prices to rise 4.3 per cent over the next 12 months. That is a full point higher than in the previous month, when they anticipated prices would rise by 3.3 per cent. Over the longer term, inflation expectations were steadier, rising from 3.2 per cent to 3.3 per cent.

Tariff Talk Took A Toll

In a Friday afternoon press conference, President Trump indicated he will implement reciprocal tariffs next week, although he did not specify which countries will be affected. “The tariffs would be the next volley in a trade war pitting the U.S. against some of its largest trading partners. Trump announced levies of 25 [per cent] against Canadian and Mexican imports last weekend, though suspended them for a month after the countries agreed to increase border security and measures to reduce the flow of illegal drugs into the [United States]. A separate 10 per cent tariff against Chinese imports went into effect, and China responded with tariffs of its own,” reported Joe Light of Barron’s.

Employment Remained Relatively Stable In January

The U.S. employment report showed hiring was solid in January, but less robust than expected, reported Lucia Mutikani of Reuters. The data showed “strong wage growth last month, with average hourly earnings surging by the most in five months, which should keep consumer spending supported.”

While a steady labour market was encouraging, investors have some concerns about the future, reported Megan Leonhardt of Barron’s. “Looking ahead, employment conditions could face more headwinds as federal policy changes take hold, and many economists expect to see further weakening within the U.S. labour market this year. The shifts in trade and immigration policies, in particular, could upend the relative stability currently on view in the labour market, as well as impede the downward progress inflation has made.”

On Friday, major United States stock indices gave back gains from earlier in the week and ended the week lower. The yield on the benchmark 10- year U.S. Treasury moved lower over the full week before rising on Friday.

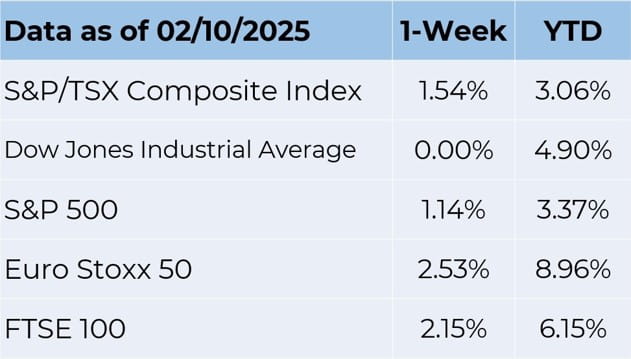

Source: FactSet

Considering Places to Retire.

A recent survey found that about one-third of Americans plan to retire in their current city, 42 per cent want to move to a different city or state, and 16 per cent intend to retire outside the United States, according to The Currency. A key factor in decisions about where to retire is financial security. More than 85 per cent of participants wanted to retire in a place where they can maintain their current standard of living without financial stress.

Where Are the Top Places To Retire In 2025?

According to Adam McCann of WalletHub, the top three states for retirement (based on 46 factors that include tax rates, cost of living, quality of medical care, and entertainment) are:

- Florida ranks first overall, and second for affordability. The cost of living in the state has risen over the past few years, driven by housing and insurance costs, though. The average homeowners’ insurance premium rose by almost 60 per cent from 2019 to 2023, reported Michelle Conlin and Matt Tracy of Reuters.

- Minnesota ranks second overall, and first for healthcare. The state has some of the best healthcare in the country. The state boasts “the most health care facilities, the second-most nursing homes, and the third-most home health care aids per capita. Its geriatrics hospitals also rank as the fifth best in the nation. Due to the great health care conditions within the state, Minnesota has the third-lowest percentage of seniors with a disability, the fourth-lowest percentage with poor mental health, and the fifth-highest percentage who are in good physical health.”

- Colorado ranks third overall. It is a tax-friendly state with no estate or inheritance taxes. “In addition, it has the seventh-lowest poverty rate for residents ages 65+… plenty to keep seniors active and engaged. For example, it has the sixth-most volunteer opportunities, the ninth- most scenic byways and the 11th-most theaters per capita.”

About two-thirds of Americans say that saving for retirement is a financial priority, and that their happiness in retirement depends on achieving their retirement savings goals. If you would like to learn more about saving for retirement, get in touch. We can help.

Weekly Focus – Think About It

“It is never too late to be what you might have been.”

—George Eliot, novelist

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.