Weekly Market Commentary September 5 2024

The Markets

After gyrating wildly throughout the month, major U.S. stock indexes finished August higher.

Despite a lot of uncertainty and some dramatic ups and downs, the Standard & Poor’s (S&P) 500 Index rose 2.3 per cent in August, while the Dow Jones Industrial Average gained 1.8 per cent to close at a record high. It was the fourth consecutive month of gains for both indexes, reported Connor Smith of Barron’s.

The month’s most remarkable comeback belonged to the Nasdaq Composite Index which eked out a 0.6 per cent gain for the month. “That's a shocking turnaround, given the Nasdaq entered correction territory early in the month…,” reported Smith. (A correction is a decline of at least 10 per cent.)

On the other hand, Canadian equities were on a roll, with the main stock index, the Toronto Stock Exchange, climbing one per cent for the month, outperforming the Nasdaq 100. While the rally was mostly fueled by gains in the financial and technology sector, it also came as investors cheered strong U.S. data that showed the economy was not on the cusp of recession.

Additionally, the gains in the Canadian equity markets come amid growing optimism about the economy, which grew at a faster rate than expected at an annualized pace of 2.1 per cent in the second quarter.

The speed of economic growth surpassed what economists and the Bank of Canada had anticipated, extending the upward revision of the first quarter's growth rate to 1.8 per cent, which pushed the recovery forward. The expansion was fueled by government expenditure and rises in wages, which remained supported by population growth driven by immigration.

Additionally, the growth received a boost as the Bank of Canada moved to cut interest rates and promised further cuts before year-end. The Canadian central bank is expected to cut interest rates for the third time in September, with further cuts expected in October and December.

Additionally, earnings growth has been positive for the first time since the fourth quarter of 2022. It also continues to offer support to the Canadian equity markets. Expectations for an acceleration to double-digit growth in 2025 also continue to fuel the buying spree. The upshot is that corporate profits remain on solid ground, providing ongoing support to the bull market despite periodic shifts in investor sentiment.

As sentiment calmed, the CBOE Volatility Index (VIX), which gauges how volatile investors expect the market to be over the next 30 days, moved lower. “Wall Street’s ‘fear gauge’—the VIX—dropped to 15. That’s after an unprecedented spike that took the index above 65 during the Aug. 5 market selloff,” reported Rita Nazareth of Bloomberg.

Why did investors regain their confidence?

There was some good economic news last week that proved to be just what markets were hoping to see. The data were strong enough to allay fears the economy might weaken too fast, but not so strong they might cause the U.S. Federal Reserve (Fed) to change its mind about lowering the federal funds rate in September. Here’s what happened:

- The economy remains steady. Investors have been worried U.S. economic growth might be slowing more quickly than previously thought. Those concerns were soothed when the Bureau of Economic Analysis revised its estimate for gross domestic product (GDP)—which is the value of all goods and services produced in the U.S.—from April through June. “The U.S. economy grew faster than initially thought in the second quarter amid strong consumer spending, while corporate profits rebounded, which should help to sustain the expansion,” reported Lucia Mutikani of Reuters.

- Inflation continues to soften. On Friday, one of the Fed’s favoured inflation gauges—the personal consumption expenditures (PCE) price index—showed headline inflation was 2.5 per cent year over year. Core inflation, which excludes volatile food and energy prices, was up 2.6 per cent year over year. “The soft price growth continues a recent stretch of cooler inflation readings and falls in line with what Fed officials were hoping to see before easing their restrictive monetary-policy stance,” reported Megan Leonhardt of Barron’s.

Last week, major U.S. stock indices moved higher. Yields for U.S. Treasuries with shorter maturities moved lower over the week, while yields for longer maturities moved higher.

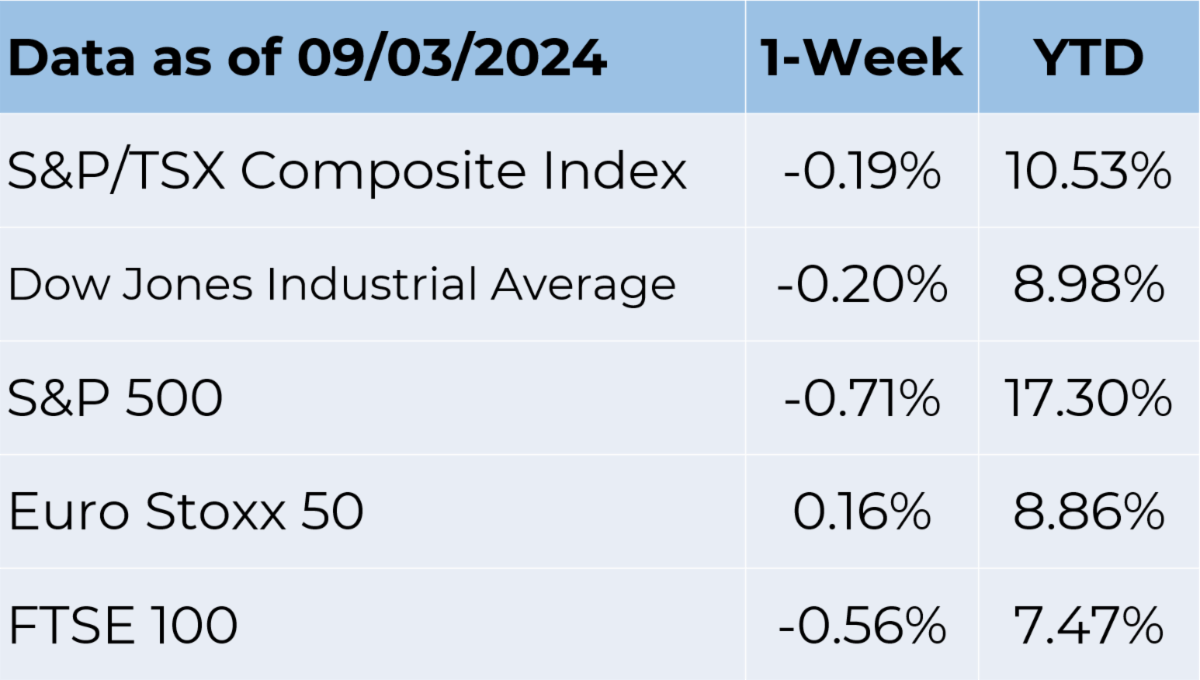

Source: FactSet

While Canadian equities finished August on a high, the main stock index started September on a low as a pullback from a record high came into play. Since September is historically a bad month for equities, investors have started taking profits, fueling a pullback in Canadian stocks.

Canada's main stock index remains under pressure amid broad-based losses in the mining and energy sectors. The weakness is being fueled, as investors await the Bank of Canada's monetary decision on Wednesday.

GDP stands as the final significant measure accessible to the Bank of Canada prior to Wednesday's interest rate announcement. The Bank of Canada had forecasted a yearly expansion rate of 1.5 per cent for the April-to-June timeframe and its latest review suggests an increase to 2.8 per cent growth in the third quarter.

WE JUST WANT TO HAVE FUN! When you live a busy and sometimes stressful life, play can be important for your health. Adam Piore of Newsweek reported, “A weighty and growing body of evidence—spanning evolutionary biology, neuroscience and developmental psychology—has in recent years confirmed the centrality of play to human life. Not only is it a crucial part of childhood development and learning but it is also a means for young and old alike to connect with others and a potent way of supercharging creativity and engagement.”

The idea dovetails with a cultural trend known as “kidulting.” The Economist reported on the rise of kidulting, “…where adults engage in lighthearted activities traditionally designed for children…a giant ball pit for adults in three British cities, welcomes 25,000 visitors each month. Even museums and immersive exhibitions typically aimed at actual children now host adult-only evenings…Enthusiasts say that such spaces heighten creativity, human connection and joy, triggering the pleasure-seeking chemical [dopamine].”

New museums have popped up to help adults unleash their inner child. For example, the Museum of Ice Cream offers a fun-dae out for adults (children are welcome, too). They can frolic in pools of artificial ice cream sprinkles, engage with themed playscapes, and eat ice cream.

The WNDR Museum offers a completely different kind of fun. It engages visitors through interactive experiences with installations like The Wisdom Project that asks visitors to answer the question, “What do you know for sure?” and requests that they consider what information is important enough to put out into the world. Museum visitors also can use imagination to create AI-generated artwork or visit the Quantum Mirror, “an infinity room with over 150 mirrors that touches on our interaction with technology. Our obsession with screens, the way that our self-perception has changed as social media has become more popular in our society.”

The National Institute for Play cautions that, while play is important for adults, what one person embraces as play may be an annoyance to another. Instead of interactive museums, your jam may be a fantasy football league, a book club or a hike in the woods. What do you do just for the fun of it?

Weekly Focus – Think About It

“It’s very important that we re-learn the art of resting and relaxing. Not only does it help prevent the onset of many illnesses that develop through chronic tension and worrying; it allows us to clear our minds, focus, and find creative solutions to problems.”

–Thich Nhat Hanh, Buddhist monk and author

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.