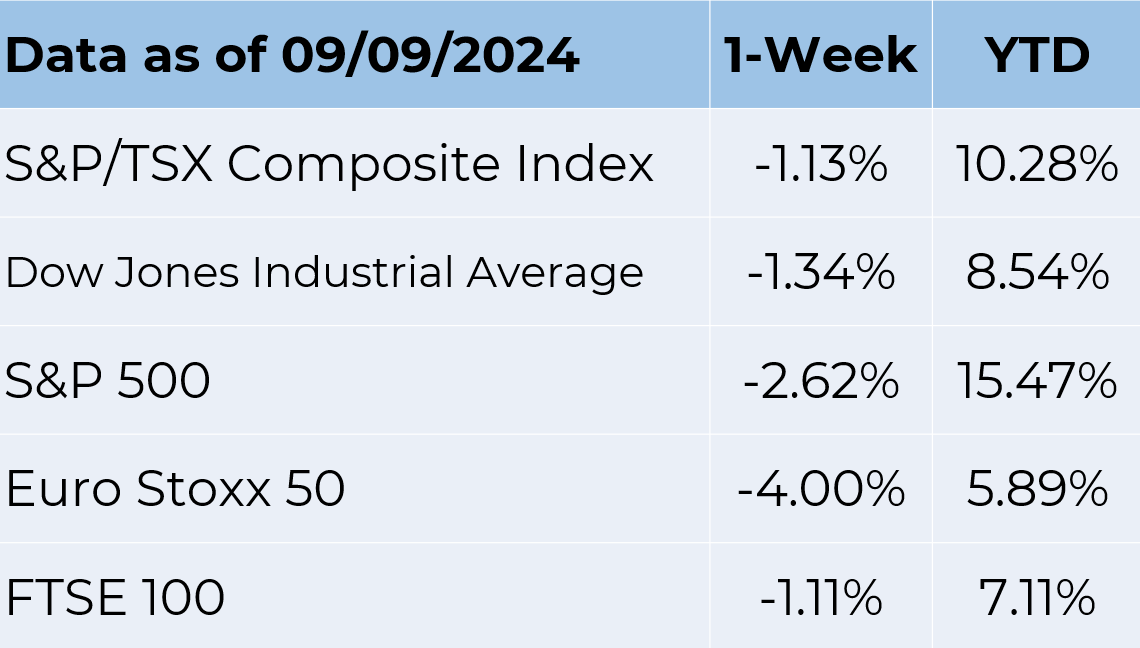

Weekly Market Commentary September 12 2024

The Markets

Investing in September can be like biting into a jelly doughnut and finding boiled cabbage—full of unwelcome surprises.

“History suggests September is the worst month of the year in terms of stock-market performance,” reported Isabel Wang of Morningstar.

It has been one of the worst-performing months for the S&P/TSX Composite Index. Over the past 10 and 20 years, the Canadian stock market has generally experienced negative average returns in September.

There are various factors influencing performance: employment rates, GDP growth, and inflation can significantly impact market performance. For instance, recent data showed Canada's unemployment rate climbing to 6.6% in August 2024, which could contribute to market uncertainty, signaling trouble in an economy subjected to higher interest rates.

The Canadian market is heavily influenced by the energy and materials sectors. Over the last seven days, the Canadian market has dropped 2.3%, driven by pullbacks in the energy and materials sectors of 4.8% and 6.4%, respectively. However, it is up 12% over the past year, with earnings forecast to grow by 15% annually.

The Canada Ivey Purchasing Managers Index dropping to 48.2 in August from 57.6 in July further affirms the economic contraction activity concerns. It's becoming increasingly clear that the Canadian economy is slowing under the high interest rates, even with the Bank of Canada cutting three times.

While the Bank of Canada has already initiated a 75-basis-points reduction of the benchmark rate to 4.25%, expectations are high that it will initiate additional cuts before year-end. Interest rate cuts are key policy measures to help slow the economic downturn.

🎉 Congratulations to Ruben Jimenez for passing the CFP Exam! His certification elevates the Muir Investment Team, now boasting four certified financial planners. We’re thrilled to offer personalized financial strategies, ensuring precise guidance for each client’s journey. Join us in celebrating Ruben’s remarkable achievement! #TeamMuir #FinancialFuture

Lending rates are still very high. So, to me, it's the start of an interest rate decreasing cycle that will continue going forward, until the Bank of Canada finds that neutral rate, whatever that may be.

The reduction in interest rates significantly impacts homebuyers in Canada, especially those currently on the sidelines. Typically, mortgage rates mirror the overnight interest rates the central bank sets. Following the previous reductions by the Bank of Canada, all the major Canadian banks have reduced their mortgage rates.

The typical five-year fixed rate from the Big Six banks has decreased from 5.5% at the beginning of the year to approximately 4.5% currently, and it could go lower after Wednesday's adjustment. This change in fiscal policy could make it easier for many Canadians to achieve homeownership.

The Standard & Poor’s (S&P) 500 Index “has generated an average monthly decline of 1.2%...dating back to 1928, according to Dow Jones Market Data.”

One reason for the sharp stock market decline last week appeared to be concerns that the Federal Reserve may have waited too long to lower rates. During the week, economic data continued to present a mixed picture of the U.S. economy. The employment report released on Friday showed the United States added about 142,000 jobs in August—a significant increase from July—and that average hourly earnings were up 3.8% year over year. In addition, the unemployment rate ticked lower to 4.2%.

However, the report wasn’t quite as rosy as those numbers suggest. Fewer jobs were created than economists had predicted and “downward revisions from the two previous months suggest that the labour market is cooling faster than the initial data may indicate,” reported Lauren Kaori Gurley and Rachel Siegel of The Washington Post.

The information has some pundits speculating that Fed officials may opt for a larger rate cut than originally anticipated at the Fed meeting in September, according to CME FedWatch. On Friday, Federal Reserve Governor Christopher Waller said he supports a September rate cut and was “open-minded about the size and pace of those reductions,” reported Ann Saphir of Reuters.

We are thrilled to announce that our Financial Advisor Associate, Rubin Chernenko, has achieved not one, but TWO prestigious certifications this year: Certified Financial Planner (CFP) and Chartered Investment Manager (CIM)! 🏆 These accomplishments are a testament to Rubin's dedication, expertise, and commitment to excellence. With these new credentials, he brings even more value to our team, enhancing our ability to provide top-notch financial planning and investment management services. Join us in congratulating Rubin on this incredible milestone! 👏 #TeamSuccess #CFP #CIM #FinancialExcellence #ProfessionalGrowth

In recent weeks, investors have been feeling quite bullish, according to the AAII Sentiment Survey. During the last two weeks of August, more than 50% of survey participants indicated they expected the stock market to rise over the subsequent six months. The level of optimism among survey participants came close to the survey’s all-time high (52.9% on December 20, 2023) and remained well above the historical average of 37.5%.

Last week, investor sentiment shifted. Fewer participants were bullish – and fewer participants were bearish. The number of respondents who were neutral increased, which means they think stock prices will remain relatively unchanged over the next six months.

By the end of last week, major U.S. stock indices had moved lower, while bond markets rallied. U.S. Treasury yields fell across the yield curve and finished the week with the yield on the benchmark 10-year U.S. Treasury above the yield on the 2-year U.S. Treasury for the first time since July 2022, reported Connor Smith of Barron’s.

When markets are volatile, as they were last week, it’s normal for investors to worry. Before making any changes in response to short-term market fluctuations, remember that historical performance supports the idea that staying invested is a sound way to pursue long-term financial goals. If you have any questions about recent market volatility or your investments, please get in touch.

Source: FactSet

Disappointing economic data was the catalyst behind Canada's stocks remaining under pressure, resulting in five days of losses last week. Nevertheless, the country's main stock index, the Toronto Stock Exchange, edged higher for the first time on Monday, bolstered by gains in the financials and industrial sectors.

The TSX was up by 1.1 to 23,027 after closing at its lowest level in three weeks last week. Part of the gains recorded on Monday came from investors taking advantage of the depressed valuations after the recent deep pullbacks. Investors are increasingly looking for bargains in the market, amid expectations that the U.S. Federal Reserve will carry out a 50-basis-point cut next week, which should offer much-needed support to the equity markets.

THE STRANGE STORY OF TRANSPARENT MICE. A big challenge for medical and biological researchers is an inability to see inside living creatures. Sophisticated imaging techniques are helpful, but they don’t always provide a clear picture. That may be about to change. Researchers at Stanford University:

“…found that a yellow food dye called tartrazine, used to colour everything from M&Ms to Gatorade, can, if applied to the skin of a live mouse, make the tissue transparent. The effect was pronounced enough for researchers to see blood vessels beneath the animal’s scalp, some of its abdominal organs and a number of the more delicate muscles in its legs—sights hitherto only directly visible through dissection. When the dye was washed off, the skin’s natural opacity returned,” reported The Economist.

Why does yellow food dye make it possible to see through mouse skin? In general, skin is opaque because fats, protein, and water scatter light and prevent it from passing through the skin. Food dyes are great light absorbers. As a result, a combination of tartrazine and water applied to mouse skin helps light travel more directly through the skin, making it transparent.

The discovery may have a wide variety of applications, according to a source cited by Carolyn Y. Johnson of The Washington Post. The technique could someday help researchers:

- Observe brain activity;

- Diagnose deep tumours without surgery;

- Locate veins more easily for IVs and blood draws; and

- Make cosmetic procedures (like tattoo removal) more precise.

The lead researcher on the study, which was published in the print issue of the journal Science on September 6, Dr. Zihao Ou, told The Economist, “It will take more work before humans are added. As human skin is ten times thicker than that of mice, replicating the tartrazine experiment would require far longer application periods…It is also unclear just how reversible such a process would be.”

Clearly, there is more work to be done!

Weekly Focus – Think About It

“The real voyage of discovery consists not in seeking new landscapes, but in having new eyes.”

—Marcel Proust, novelist

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.