Weekly Market Commentary September 19 2024

The Markets

There was a lot of good news last week!

The Canadian economy’s recovery, having come under pressure amid high interest rates, is gathering steam. Various sectors of the economy are showing signs of recovery in response to the Bank of Canada cutting interest rates by 50 basis points.

The impact of the low interest rates is also being felt in the equity markets, going by the major indices racing to record highs. The Toronto Stock Exchange hit a record peak on Friday in a widespread surge, driven by a rally across the board, with mining shares leading the way. The rally came on hopes that the U.S. Federal Reserve would choose a significant reduction in interest rates during its upcoming policy meeting.

The Toronto Stock Exchange was up 93.51 points, or 0.4 per cent, reaching a new all-time high of 23,568.65, breaking through the previous record it achieved on Thursday. Over the week, the index surged 3.5 per cent, marking its largest weekly increase since October. The rally continued Monday with the index recording a new all-time high of 23,702 driven by gains on the energy and technology sectors.

The rally in the equity market comes on the backdrop of impressive Canadian economic data. The country's industrial capacity utilization rose in the second quarter, attributed to increased activity in the natural resource sector.

The latest data indicate that companies in the country operated at 79.1per cent of their production capacity in the second quarter, which is attributed to solid consumer purchasing power on goods and services. With low interest rates in the aftermath of the Bank of Canada cutting by 50 basis points, there is more liquidity, resulting in a strong demand for goods and services and, therefore, fueling industrial activities.

In July, Canada's building industry experienced a robust recovery, with a significant rise in the issuance of building permits, driven by a renewed interest in developing multi-unit housing projects.

The aggregate value of the building permits surged 22.1 per cent to $12.4 billion, marking a reversal of the previous two-month downward trend. The growth was driven by residential and non-residential sectors, but the surge in multi-unit construction particularly highlighted this trend.

The residential sector experienced a 16.7 per cent increase, with the development of multi-unit housing playing a leading role. Permits for these types of buildings saw a 29.3 per cent increase, reaching $5 billion. This surge was a key contributor to the sector's overall expansion, despite a slight decrease in permits for single-family homes by 1.9 per cent.

Meanwhile, the U.S. economy, which has been showing signs of slowing down, depicted by weakness in the labour market, is also on the cusp of receiving a significant boost. The U.S. Federal Reserve received the much-needed reason, last week, to start easing monetary policy in the aftermath of inflation levels dropping significantly.

Inflation continued to trend lower. The Consumer Price Index showed that inflation was 2.5 per cent year over year (yoy) in August. That’s lower than economists had expected, and a significant decline from July’s 2.9 per cent.

Food and energy prices have been falling faster than some other prices because the core CPI, which excludes food and energy, showed a 3.2 per cent increase over the last 12 months. The biggest price increases were for shelter (+5.2 per cent yoy) and automobile insurance (+16.5 per cent yoy).

Consumers are happier. The University of Michigan’s Consumer Sentiment Survey found that optimism is on the rise. “Year-ahead expectations for personal finances and the economy both improved as well, despite a modest weakening in views of labour markets. Sentiment is now about 40 [per cent] above its June 2022 low, though consumers remain guarded as the looming election continues to generate substantial uncertainty,” reported Surveys of Consumers Director Joanne Hsu. “Year-ahead inflation expectations fell for the fourth straight month, coming in at 2.7 [per cent].”

Household net worth is up in the United States. Last week, the Federal Reserve reported on the financial well-being of households and nonprofit organizations at the end of June 2024. Over the last decade, household and nonprofit net worth has risen from $85 trillion (2Q 2014) to $164 trillion (2Q 2024). Vince Golle of Bloomberg reported:

“U.S. household wealth reached a fresh record in the second quarter, fueled by a steady rise in the value of real estate and Americans’ stock holdings...The value of real estate held by households climbed about $1.75 trillion, the most in a year, while the value of equity holdings rose about $662 billion.”

It’s important to note that not all Americans participate equally as wealth grows. The top 10 per cent of households hold 67 per cent of all household wealth, while the bottom 50 per cent hold just 2.5 per cent, according to the St. Louis Federal Reserve.

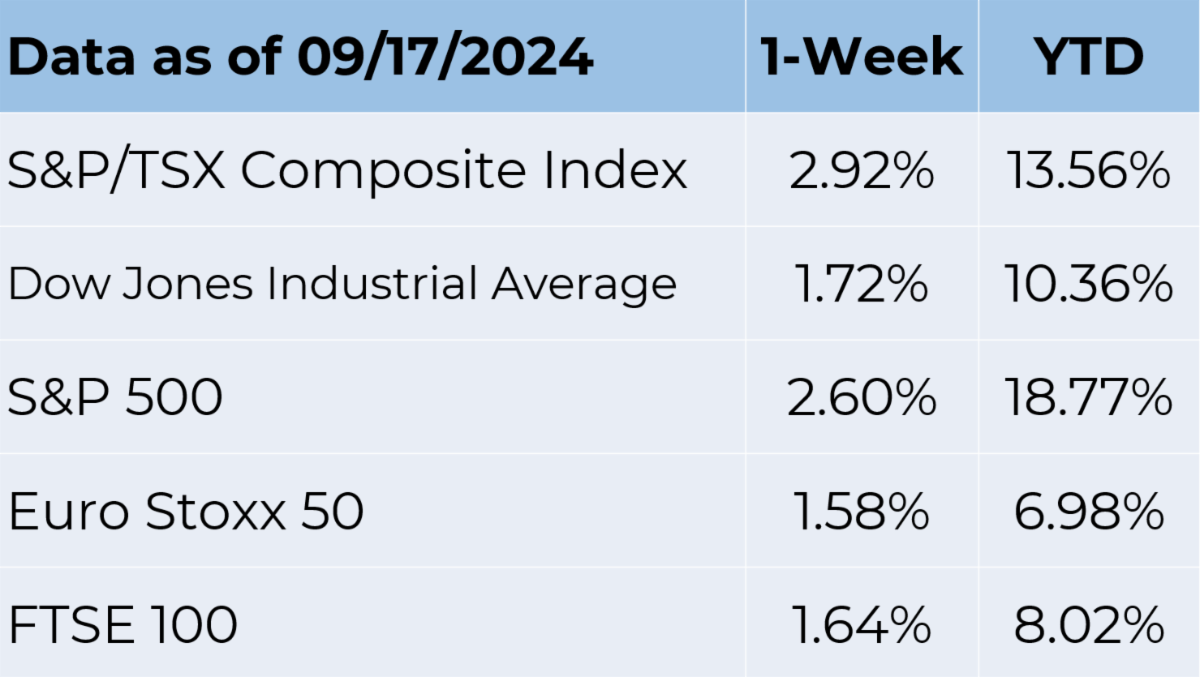

Stocks and bonds had a good week. Last week, major U.S. stock indices moved higher, and U.S. Treasury bonds rallied as yields on all maturities of Treasuries moved lower.

Source: FactSet

As mentioned earlier, Canada's main stock index, the S&P/TSX Composite Index, reached new record highs recently. The index closed at 23,568.65 on September 13, 2024, surpassing its previous record.This rally was driven by widespread gains across various sectors, with mining stocks leading the charge. The surge was fueled by investor optimism regarding potential interest rate cuts by the U.S. Federal Reserve.

The index continued its upward trajectory, hitting a new intraday high of 23,702 on the following Monday, propelled by gains in the energy and technology sectors. Over the week, the index recorded a 3.5 per cent increase, marking its strongest weekly performance since October.

WHICH IS MORE POPULAR: BUTTER, ICE CREAM, YOGURT, OR CHEESE? My best guess was ice cream, but that’s not the case. Llena Peng of Bloomberg explained, “America’s per capita cheese consumption has more than doubled since the government began keeping track in 1975, to about 42 pounds a year—more than all the butter, ice cream and yogurt combined.”

When it comes to dairy products, cheese is the big cheese. As milk consumption has declined, cheese eating has accelerated. According to the United States Department of Agriculture (USDA), rising demand for cheese has become “one of the most important forces shaping the U.S. dairy industry.”

The popularity of cheese owes much to the pandemic, according to Bloomberg’s Peng. It may be that working from home improved proximity to refrigerators or that efforts to recreate favourite restaurant meals elevated demand for cheesy goodness.

Either way, the global market for cheese is growing, and the cheese snack market is expected to expand “at a compound annual growth rate of 6.5 [per cent] through 2034,” reported Corey Geiger, Abbi Prins and Billy Roberts for the CoBank Knowledge Exchange. According to one company’s survey, the most-produced, top-selling, and most widely eaten cheeses in the U.S. include:

- Cheddar,

- Mozzarella,

- Parmesan,

- American, and

- Cream cheese.

That list did not include cottage cheese, which has been having a moment on social media. “People have taken to [a social media site] to show how cottage cheese can be used in better-for-you recipes, with creative dishes like viral cottage cheese flatbread and ice cream. At-home followers looking to recreate these recipes have helped cottage cheese boost dairy sales,” reported Gabriela Barkho of Modern Retail. “According to Circana data from May, cottage cheese sales were up 13.5 [per cent] year-over-year, up to $1.33 billion.”

What’s your favorite cheese?

Weekly Focus – Think About It

“A cheese may disappoint. It may be dull, it may be naive, it may be oversophisticated. Yet it remains cheese, milk's leap toward immortality.”

—Clifton Fadiman, television and radio personality

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.