Weekly Market Commentary September 26 2024

The Markets

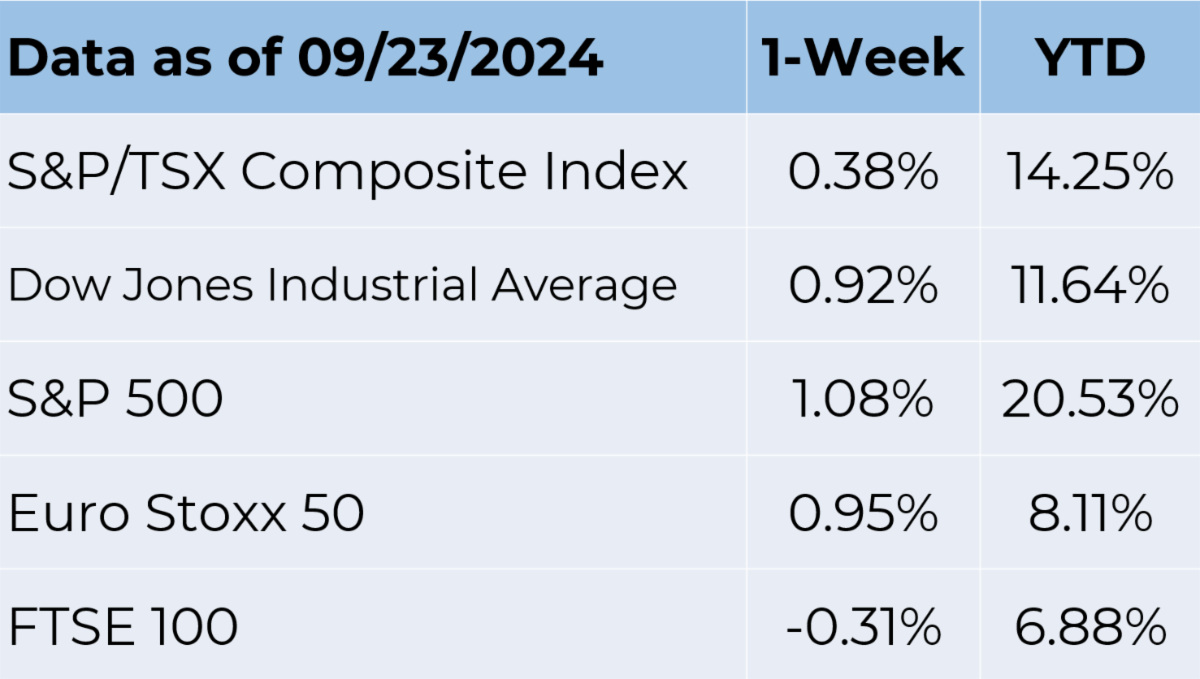

Rates moved lower and stocks moved higher.

Bank of Canada could carry out a 200 basis points interest rate cut between now and the middle of next year. That sentiment was echoed by CIBC senior economist Andrew Grantham as inflation remains unthreatening in the aftermath of three rate cuts of 75 basis points.

The sentiments come on the inflation rate declining to the recommended 2% in August, hitting the Bank of Canada’s target. Like many other central banks, the BoC began hiking interest rates aggressively in 2022 to tame runaway inflation.

The high interest rate environment has already had its impact as inflation continues to edge lower, helped by a drop in gasoline prices. With inflation ticking lower, the BoC conducted its third consecutive interest rate cut of 25 basis points earlier in the month.

Nevertheless, even with inflation at 2%, some Canadians do not feel the impact of lower inflation. Prices of groceries and other goods remain high even with the pace at which prices increase.

The BoC governing council has already indicated that if signs of weakness in the labor market and broader market persist, it might increase the pace of interest rate cuts.

Likewise, the Bank of Canada is not targeting prices to return to where they were before the pandemic or the considerable inflation period. Similarly, the central bank does not want to reach zero percent inflation as it could lead to negative inflation, which could seriously impact the economy.

The US economy has also been struggling amid the high interest rate environment, with manufacturing activities under pressure due to weakness in the labor market. Consequently, the country’s central bank has already swung into action.

In 2022, the United States Federal Reserve (Fed) began raising interest rates as it battled high rates of inflation. That year prices rose 8 percent, as measured by the Consumer Price Index. In 2023, prices increased more slowly (4.1 percent), but still advanced at a pace that was well above the Fed’s target of two percent. Last month, prices rose 2.5 percent annualized. And last week, the Fed decided it is time to change course.

“On Wednesday, policymakers indicated their rate cut would likely be the first of several through the end of next year. The median forecast among members of the Federal Open Market Committee was that the benchmark federal-funds rate will be at 3.4 [percent] by the end of 2025, compared with the current targeted range of 4.75 [percent] to 5 [percent],” reported Elizabeth O’Brien and Shaina Mishkin of Barron’s. “This marks a significant shift. The Fed has moved from a phase when it kept rates high to combat inflation to one where it is lowering them to support the labor market and the broad economy.”

As borrowing costs move lower, other interest rates are likely to follow. As a result, consumers, investors, and business owners may have opportunities to:

- Pay lower interest rates on auto and home loans,

- Refinance mortgages at lower rates, and

- Tap into home equity at a lower cost.

Major U.S. stock indices rose on Thursday, following the Fed’s rate cut. “The S&P 500 climbed 1.7 [percent]—notching its 39th record in 2024 and extending this year’s surge to about 20 [percent],” reported Rita Nazareth of Bloomberg. “The Fed’s bold start to cutting interest rates and its determination not to fall behind the curve re-ignited hopes the central bank will be able to avoid a recession. Data Thursday showing a slide in jobless claims to the lowest since May signaled the labor market remains healthy despite a slowdown in hiring.”

Stocks gave back some gains on Friday but finished week higher. Yields on U.S. Treasuries were mixed over the week.

Source: FactSet

Similarly, Canada’s main stock index, the Toronto Stock Exchange, is also at an all-time high as interest rates drop and commodity prices rally. The exchange has gained more than 14% year to date as investors invest in more riskier assets amid expectations that the interest rate cut spree will have a positive impact on the investment environment.

The Toronto Stock Exchange, predominantly focused on commodities, is benefiting from an increase in prices this year across various categories, including industrial metals like copper to valuable metals like gold. Investors appear to view the announcement of a rate reduction as beneficial for the flow of money, ignoring worries that lowering interest rates might indicate an economy in decline.

YOU'RE TALKING MY LANGUAGE! They say the only constant is change, and that’s certainly the case when it comes to language. Pronunciations, meanings and syntax often change gradually. However, some changes, especially when it comes to vocabulary, occur quite quickly. For instance, “social media,” “content curation,” and “influencers” are recent additions to the lexicon of American English. There is one aspect of language that has been modified by every generation—slang. See what you know about generational jargon by engaging with this brief quiz.

- Which term describes a person who is pretending to be someone else while chatting online?

- Goat

- Catfish

- Chameleon

- Octopus

- In the 1950s, when something was “radioactive,” it was:

- Exhausting

- Toxic

- Popular

- Crazy

- Which of these is not a choice example of 1980s slang?

- Wannabe

- Not even

- Psych

- Bae

- When you give someone the "side-eye", what are you doing?

- Looking at them with suspicion

- Checking them out without being obvious

- Flirting with them

- Admiring their clothing or accessories

- If you’re feeling resentful or bitter, someone might accuse you of being:

- Blue

- Salty

- Sus

- Delulu

Weekly Focus – Think About It

“Slang is a language that rolls up its sleeves, spits on its hands and goes to work.”

—Carl Sandburg, poet

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.

Answers:

- b (Catfish)

- c (Popular)

- d (Bae)

- a (Looking at them with suspicion)

- b (Salty)