Weekly Market Commentary October 7 2024

The Markets

Canadian economy slowing down amid low interest rates

The Canadian economy appears to have lost some steam, even with the Bank of Canada cutting interest rates to try to avert a recession. Immediate data indicates that the Gross Domestic Product remained unchanged in August.

In contrast, The gross domestic product grew by 0.2% in July, but August seems to have slowed down, putting economic activity below the Bank of Canada's forecast and possibly supporting the case for a bigger interest rate cut next month.

In Q3, Canada's real GDP growth is growing at a pace of less than 1.5%, below potential, and even slower than a year ago. This indicates that the economy is becoming even more slack, which will ultimately drive inflation lower.

The central bank has lowered interest rates three times in a row since June, raising its benchmark rate to 4.25% each time. Tiff Macklem, the governor of the Bank of Canada, has made hints in recent weeks that if inflation and economic growth slow down more than anticipated, he and his team may implement a larger half-percentage-point cut.

Monetary policymakers in Canada are growing increasingly concerned about downside risks to economic growth and the rising rate of unemployment, which reached 6.6% in August, as the rate of inflation has returned to a more normal level and hit the bank's 2-percent target in August for the first time since 2021. In a speech this week, Mr. Macklem stated that economic activity needs to increase to keep inflation from dropping below 2% on the way down.

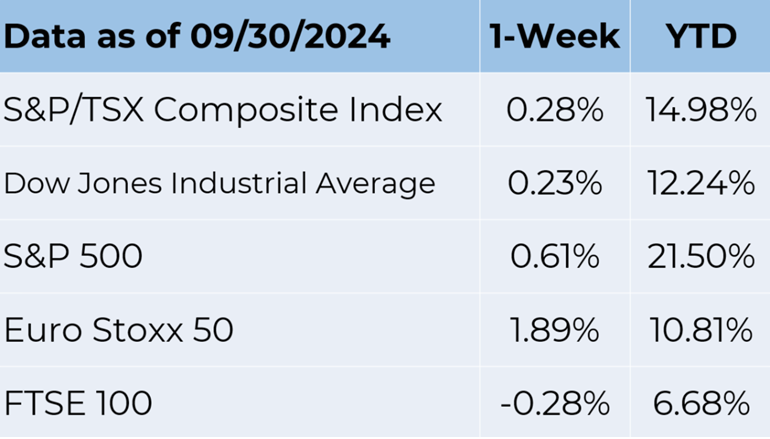

Meanwhile the Standard & Poor’s (S&P) 500 Index hit a new all-time high last week.

The S&P 500 has had quite a year. Despite a sharp downturn in August when investor confidence was ruffled by concerns about economic growth, the Index was up about 20 percent, year-to-date, at the end of last week. The gains were widespread with all sectors of the Index participating, according to data from Fidelity.

Last week, investor enthusiasm was bubbling up. There were a lot of reasons for their optimism. First, investors were encouraged by the Federal Reserve’s rate reduction earlier this month and expectations that the Fed will continue to reduce the federal funds rate further to support economic growth. Jacob Sonenshine of Barron’s explained the advantages conferred by the Fed’s actions:

“Lower rates would only boost consumer spending on housing and other goods and services—a demand picture that will spur investment from companies, helping the industrial economy specifically. This all means companies’ profit growth could easily extend from next year into 2026. Analysts expect S&P 500 companies, in aggregate, to generate annual sales growth just above 5 [percent] over the coming two years, according to FactSet.”

Second, a round of positive economic news helped investors set aside any lingering concerns about economic growth. Brian Evans and Lisa Kailai Han of CNBC reported:

“A slate of fresh data supported a solid economy, easing fears that perhaps the Federal Reserve is cutting rates aggressively because of a potential slowdown. Weekly jobless claims fell more than expected, pointing to a steady labor market. Durable goods orders for August were unchanged versus economists’ expectations for a decline. Further, the final reading of second-quarter GDP was unrevised at a strong 3 [percent].”

In addition, inflation continued to trend lower in August. The Fed’s favored inflation gauge, the personal consumption expenditures index, indicated prices rose 0.1 percent. Megan Leonhardt of Barron’s reported:

“The August pace [of inflation] was also lower than consensus calls…The latest data show that the annualized three-month core PCE is currently running below the Fed’s 2 [percent] inflation target. It should help erase any doubts that the Federal Open Market Committee made the right call when it slashed benchmark interest rates by a half percentage point earlier this month.”

Last week, the S&P hit a new all-time high, as well as a record close. The Dow Jones Industrial Average and Nasdaq Composite Index also rose last week. After rising earlier in the week, yields on many maturities of U.S. Treasuries moved lower on Friday after inflation news shored up expectations for further Fed rate cuts.

Source: FactSet

On the other hand Canada's main stock index recorded its third consecutive weekly gain last week, thanks in part to recent interest rate reductions by the central bank that encourage investors to switch from cash to high-dividend stocks. After setting a record closing high the day before, the Toronto Stock Exchange pulled back by 0.3% after powering through the 24,000 psychological level.

The rally in the Canadian market comes from value investing strategies, dividend-yielding securities, and low-vol (volatility) performance. They are performing well as investors react to the interest-cutting cycle in the US and Canada.

THERE'S A NEW TWIST TO HOME BUYING AND SELLING. Mortgage rates have been moving lower. Last week, the average 30-year fixed rate mortgage dropped to the lowest level in two years, reported Claire Boston of Yahoo! Finance. This was welcome news to anyone hoping to buy a home.

Climate conscious buyers are also likely to be enthusiastic about a new feature being rolled out by an online real estate marketplace. The digital listing service is partnering with a climate risk financial modeling group to provide additional climate risk information to buyers.

“When viewing a for-sale property…home shoppers will see a new climate risk section. This section includes a separate module for each risk category—flood, wildfire, wind, heat and air quality—giving detailed, property-specific data…This section not only shows how these risks might affect the home now and in the future, but also provides crucial information on wind, fire and flood insurance requirements,” reported the listing service.

About 80 percent of home buyers consider at least one climate risk when shopping for a house, according to a recent survey. Home buyers in the Western and Northeastern United States are more likely to be aware of and concerned about the impact of climate risks, while about a third of Midwestern and Southern home shoppers say climate factors are not a significant concern as they search for real estate.

The wisdom of considering climate risks when making major financial purchases has been evident in recent weeks as Hurricane Helene left a trail of destruction across Florida and the southeastern United States, Hurricane Francine tore into Louisiana, and flooding and wildfires have plagued regions of the United States.

It’s also critical to consider whether a property is insurable and how much the insurance will cost. The climate risk financial modeling group found that “about 35.6 million properties—a quarter of all U.S. real estate—are facing higher insurance costs and lower coverage because of climate risks,” reported Li Cohen, Tracy J. Wholf, and Marina Jurica of CBS News.

Weekly Focus – Think About It

“Risk comes from not knowing what you're doing.”

—Warren Buffett, The Oracle of Omaha

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.