Weekly Market Commentary October 17 2024

The Markets

Weekly Market Commentary October 17th, 2024

There was a lot to celebrate last week!

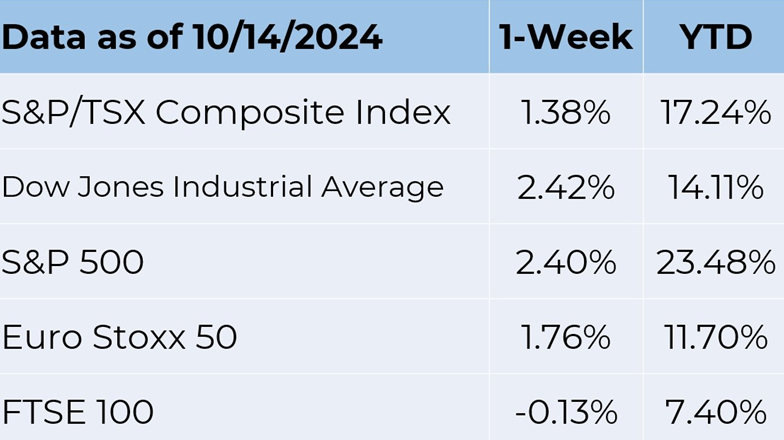

Canada's main stock index hit a record high driven by gains in tech stocks, while worries about a weak labour market were allayed by a surprise drop in the country's unemployment rate. The TSX Composite Index ended Friday at 24,471.17, marking a fifth consecutive week of gains. The Bank of Canada's string of rate cuts has helped shore sentiments in the Canadian stock market, consequently fueling a bounce back from a weak second quarter.

Last week's gains came from solid economic data, with Statistics Canada indicating the economy created 47,000 jobs in September, better than a gain of 27,000 expected. It was also higher than the 22.1k jobs created in August, as the unemployment rate fell 0.1 per cent points to 6.5 per cent.

While solid job creation and unemployment reduction indicate that the economy is doing well, there is growing concern that the Canadian labour market will remain subdued. The number of hours worked across the country dropped 0.4 per cent in September, as wage growth cooled and average hourly wages rose by 4.6 per cent, the slowest pace compared to a year earlier.

The TSX recorded a 9.3 per cent increase in the third quarter, driven by solid technological, financial, and real estate stock gains. Interest rate cuts positioned the market for a more positive outlook for the rest of the year and beyond, by reducing inflation and promoting a wider economic recovery.

The real estate market and financial services stocks have risen due to the Bank of Canada's 75-basis-point interest rate reduction so far in 2024 and the anticipated additional reductions. The BoC meets this week and must make a difficult choice of how to proceed with monetary easing.

Although September's employment report was better than anticipated and supported the case for a modest 25-bps cut, the decline in inflation increased the likelihood of a 50-basis point cut. To relieve the pressure of high rates, the BoC has lowered rates three times this year, as part of an aggressive rate-cutting cycle.

Meanwhile the Canadian Federation of Independent Business estimates that the economy grew at a slow pace of 1.2 per cent in the third quarter. Likewise, it is expected to grow at a slow pace in Q4 at 1.4%, as it continues to face headwinds even as the BoC is cutting interest rates.

Amid the economic growth slowdown, inflation remains on the right track and should stay within the Bank of Canada's target range in Q4. This ought to be a powerful incentive for the Bank to lower interest rates more frequently and more significantly in the upcoming months.

As the Canadian stock market edges to a record high, the Standard & Poor’s 500 Index also closed above 5,800 for the first time—and that’s not all.

The Dow Jones Industrial Average also notched a record high last week— and all three major U.S. stock indices ended the first full week of October with gains of more than one per cent.

There was good economic news, too.

- Inflation continued to slow in September. The Consumer Price Index showed headline inflation was 4 per cent annualized—the smallest annual increase since February 2021.

- Consumers are feeling better than they did a year ago. “[Consumer sentiment] is currently eight [per cent] stronger than a year ago and almost 40 [per cent] above the trough reached in June 2022,” reported University of Michigan Surveys of Consumers Director Joanne

- The economy continues to grow. After inflation, the U.S. economy grew by three per cent in the second quarter of Forecasts project that economic growth in the third quarter will be 3.2 per cent.

- Wages have grown faster than inflation. In September 2024, average hourly earnings were up four per After inflation, they were up 1.5 per cent. Of course, that’s a broad reading for the entire country and may not reflect individual experience.

“By just about every measure, the U.S. economy is in good shape. Growth is strong. Unemployment is low. Inflation is back down. More important, many Americans are getting sizable pay raises, and middle-class wealth has surged to record levels. We are living through one of the best economic years of many people’s lifetimes…The United States has nearly 7 million more jobs than it did before the pandemic, and the largest share of 25- to 54-year-olds working since 2001,” reported Heather Long of The Washington Post.

It's remarkable that many Americans still don’t recognize the strength of the economy. Last week, a Harvard Caps/Harris Poll found that, “63 [per cent] of voters believe the U.S. economy is on the wrong track and 62 [per cent] characterize it as weak, consistent with perceptions over the past year.”

Last week, major U.S. stock indexes finished higher. U.S. bonds appeared to be headed for a fourth-straight week of declines with the yield on a 10- year note above four per cent again.

Source: FactSet

IT'S POLICY THAT AFFECTS STOCK MARKETS. NOT POLITICS. Although presidential elections can affect financial markets over the short term, it is the policies a new President introduces that influence economic growth and the stock market. Sometimes, policies lift the economy. Other times, they don’t. For example:

President Thomas Jefferson embargoed all trade with England and France, preventing U.S. ships from doing business with other countries. While he had sound reasons for pursuing the policy, “It decimated the economy…As many as half of the working men in the New England coastal communities were unemployed. Poor houses were overflowed, banks failed," reported WBUR.

The embargo was not popular. Eventually, American merchants found loopholes that allowed them to trade with Canada and Spanish Florida. Smuggling also increased.

President Abraham Lincoln had a profound impact on the United States economy. He led the country through the Civil War, and signed the Emancipation Proclamation, which led to the end of slavery and necessitated the adoption of new economic models.

Research from the University of Chicago suggests that “emancipation generated aggregate economic gains for the U.S. economy that were worth between 4 and 35 per cent of U.S. GDP, making it, even at the low end of their estimation, one of the most important economic events in U.S. history—bigger than the introduction of railroads, by some estimates, and worth 7 to 60 years of technological innovation in the latter half of the 19th century.”

President Jimmy Carter faced an embargo—the Arab oil embargo of 1973. Demand for gasoline far outstripped supply in the United States, and Americans waited in long lines to fill their cars’ gas tanks. In response, the President developed energy conservation strategies.

“President Carter signed energy legislation that created the U.S. Department of Energy, provided incentives for renewables and coal, deregulated oil and natural gas prices, and banned new power plants from using gas or oil. Some of these policies have had a lasting effect. Others drew criticism and were ultimately repealed,” stated historian Jay Hakes on a Center for Global Energy Policy podcast at Columbia University.

While there are usually differences of opinion when new policies are implemented, the economic outcome is sometimes difficult to predict.

Weekly Focus – Think About It

“History is a jangle of accidents, blunders, surprises and absurdities, and so is our knowledge of it, but if we are to report it at all we must impose some order upon it."

—Henry Steele Commager, historian

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.