Weekly Market Commentary October 24th, 2024

Canadian Economy Faltering

The Canadian economy might have avoided a recession but faces significant turbulence heading into the year-end. Economic data suggest the economy faltered in the third quarter, even as the Bank of Canada conducted three interest rate cuts to steer it into a soft landing.

The current high-cost and high-interest-rate environment poses significant challenges to the Canadian economy and construction sector. High financing costs, limited liquidity, and decreased capital flows have all worked together to curb consumption, impede economic growth, and hinder the performance of the residential and commercial sectors.

While the economy is poised to avoid a hard landing, economists believe it only grew by 1% in the third quarter, down from 2.1% growth in the second quarter. The BoC had projected the economy to grow by 2.8%.

The lacklustre growth will see the gross domestic product fall for a sixth consecutive quarter on a per capita basis.

According to economists at the National Bank of Canada, the 2.8% growth the central bank had anticipated is essentially impossible to achieve. Economists expect the GDP per capita to decline, indicating that the economy is growing below its potential and that there is an increasing excess supply.

The Bank of Canada has indicated in a dovish manner that it is now more worried about economic downside risks and the potential for inflation to fall too low. Many economists believe that Gov. Tiff Macklem's emphasis on the need to stick the landing on inflation and the desire to accelerate growth will pave the way for more aggressive rate moves.

Meanwhile, Canada's main stock index edged to an all-time high of 24,864, on the back of solid gains in the mining and energy sector. Expectations that the Bank of Canada will conduct a 50-basis-point cut to steer the economy into a soft landing was another catalyst fueling the upward momentum in the equity markets.

The 50-basis-point cut would be the first super-sized reduction in 15 years, signaling growing concerns about the health of the Canadian economy, even as the equity market continues to edge higher. The Bank of Canada has found itself in a tough spot, amid calls to boost economic growth that faltered in the third quarter amid falling prices.

BoC Governor Tiff Macklem hinted at the prospect of more significant cuts, last month, when he stated that the bank needed to be more cautious against the risk of a crippled economy and inflation falling too much.

The Markets

Happy birthday!

The bull market in stocks charged past its two-year birthday on October 12. “This unique bull market is still young relative to history and, for now, supported by relatively healthy breadth and broadening participation,” wrote Liz Ann Sonders and Kevin Gordon of Schwab.

One factor in the U.S. stock market’s rise has been the American economy’s surprising strength as it recovers from a surge in inflation. Our economy is “the envy of the world” and “has left other rich countries in the dust,” reported Simon Rabinovitch and Henry Curr of The Economist. “Expect that to continue,” they wrote.

The strength of the U.S. economy was reflected in the release of robust economic data and solid company earnings reports last week. Here’s what happened:

- U.S. retail sales grew faster than expected in September. Retail sales data show how much Americans spent at food and retail stores. The information is considered to be a leading economic indicator, which means that it provides some insight into what may be ahead for the stock market. Will Kenton of Investopedia explained:

“Retail sales is an important indicator that signals either the contraction or expansion of an economy. An increase in retail sales signals a healthy economy that is expanding while a decrease in retail sales signals the opposite. An increase in retail sales usually moves stocks upward and is good for shareholders.”

- Third quarter earnings season was off to a good start. At the end of each quarter, publicly traded companies report on sales and profits for the previous quarter. Earnings season has a direct effect on share prices and stock market performance. “…if most companies, particularly the established market leaders, report increasing sales and earnings, traders tend to feel more confident about the market’s When earnings are trending below expectations, it can be a warning sign of potential trouble ahead,” explained Schwab.

At the end of last week, 14% of the companies in the Standard & Poor’s 500 Index had reported third-quarter performance. About 79% had beaten analysts’ earnings (profit) expectations, and 64% had beaten revenue (income) expectations, according to John Butters of FactSet.

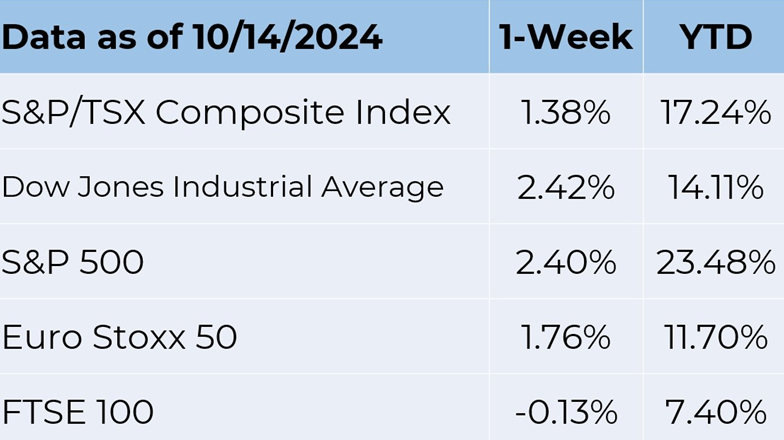

Major U.S. stock indexes moved higher for the sixth consecutive week, and U.S. Treasury yields finished last week in roughly the same place they ended the week before.

Source: FactSet

AN OFTEN-OVERLOOKED RETIREMENT RISK. When planning for retirement, there is a risk that is sometimes overlooked—the possibility of cognitive decline. It’s not fun to think about, but a significant number of older Americans experience difficulty with memory, problem-solving, concentration and other important mental tasks. Fortunately, there are some strategies that can help protect you and your loved ones.

As people age, they may not be as sharp as they once were. After 65, learning new information can take longer. Retirees, occasionally, struggle to find the right word or misplace their glasses and keys. This is normal aging that “doesn’t affect recognition, intelligence or long-term memory,” according to the Cleveland Clinic.

In some cases, though, a person experiences a more significant decline in brain function. It may be caused by a health issue, such as a stroke, or a disorder, like Alzheimer’s. About 55 million Americans live with Alzheimer’s disease or another type of dementia.

The National Institute on Aging suggests that getting enough sleep, eating healthy meals, being physically active, managing any health conditions, connecting with family and friends, and keeping your brain engaged by learning new things can help keep your brain healthy.

No matter how conscientious you are, it’s also important to organize your finances so they are easy to manage. This often means:

- Building a network of family members and professionals who understand your goals and

- Streamlining your finances, so managing money is easier as you Automating bill payment, keeping track of accounts through a centralized system, and other actions can help simplify your financial life.

- Putting appropriate planning documents in place, such as a will, a revocable living trust, a power of attorney, and/or a living will that spells out your preferences for medical

“Cognitive decline can have devastating consequences for personal finances and sound financial decision-making. The ability to manage finances is one of the first cognitive skills to deteriorate, leaving many people vulnerable to suboptimal financial decision-making and an ever- growing array of pernicious financial scams,” reported Chris Heye in Kiplinger Personal Finance.

If you would like to learn more, please get in touch.

Weekly Focus – Think About It

“Time and memory are true artists; they remould reality nearer to the heart's desire.”

—John Dewey, philosopher

Best regards

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.