Weekly Market Commentary November 1 2024

Canada Rate Cuts, Slowing Economy

Canadians can heave a sigh of relief on inflation dropping to lows of 1.6 per cent, prompting the Bank of Canada to conduct a 50-basis-point interest rate cut. After hiking rates to 20-year highs in a bid to fight soaring prices, the central bank has cut rates four times, a move that has made it easy to access capital at the low interest rates.

While the interest rate was cut to 3.75 per cent from a high of 5 per cent, signaling a period of low inflation, all is not well. The Canadian economy is struggling with slow manufacturing sales and more cautious consumer spending, which raises serious questions about the economy's health.

Economic growth also appears to have slowed, fueling suggestions of a possible recession. The slowdown is forcing the BoC to push for aggressive rate cuts to address business sales that have been sluggish and tepid consumer sentiment that's hurting economic growth. Economists expect the central bank to conduct further reductions in December if the slowdown persists.

Nevertheless, policymakers face tough choices in the race to steer the economy into a safe landing. On the monetary side, the Bank of Canada must find a way of establishing a stable exchange rate while ensuring independent market openness and independent monetary policy. For the longest time, Canada has achieved free capital mobility and an independent monetary policy rate at the expense of exchange rate stability.

Even as the BoC strives to ensure monetary policy that brings stability to the economy, the government is also grappling with its fair share of challenges. Top on the list are issues related to climate change, immigration issues, and wealth inequality, which require careful and strategic handling.

Meanwhile, Canadian equities were on the back foot on Monday, with the major index, the Toronto Stock Exchange, edging lower at the start of the week. The index was down by 1.45 per cent last week, posting its fifth straight session on the red, hurt by losses in real estate and consumer discretionary sectors.

The exchange fell slightly on Monday, as the Canadian energy sector came under pressure from a dramatic fall in oil prices. Oil prices plunged below $70 a barrel in response to Israel's limited retaliatory strike against Iran, a situation that could significantly disrupt energy supplies.

Likewise, the materials sector was also under pressure, edging lower on firmer U.S. dollar and treasury yields, with copper prices edging lower on demand worries in China.

"We had a really good start to the month," said Greg Taylor, portfolio manager at Purpose Investments. "We pulled forward a lot of good news and now people are bracing for some volatility in the next few weeks."

Likewise, there are concerns that Canada’s immigration reduction targets are likely to have an impact on Bank of Canada growth forecast, which could spill over into the equity markets on affecting sentiments.

The Markets

Financial markets appear to have pre-election jitters.

The United States election is less than two weeks away. The candidates are neck and neck. The outcome remains uncertain. And expectations for volatility have been rising, with the CBOE Volatility Index (VIX) finishing last week at 20.33.

“When the VIX goes north of 20, Wall Street pays attention because that level signals heightened volatility,” reported Connor Smith of Barron’s.

One reason for heightened volatility may be concerns about the election. Ian Salisbury of Barron’s explained, “There are plenty of theories about how particular stocks will fare, depending on next month’s outcome. It isn’t hard to see why. The candidates have tried to curry favor with voters by championing or attacking favored industries, and sometimes individual companies. Vice President Harris has promised to raise the corporate tax rate, a move that could cut into corporate earnings, and Democrats are widely seen as tougher on antitrust issues, a potential hurdle for Wall Street banks looking to capitalize on pent-up [merger and acquisition] activity. Trump, meanwhile, has threatened hefty new tariffs, which could help U.S. manufacturers but hurt multinationals. He’s even threatened individual companies like John Deere over plans to move manufacturing facilities abroad. The good news? Investors can mostly shrug the campaign rhetoric off and focus on stocks’ fundamentals.”

So far, third-quarter earnings reports have been strong. Regardless, stock market investors became significantly less bullish last week, according to the AAII Investor Sentiment Survey. The survey asked investors whether they think the stock market will move higher (bullish) or lower (bearish) over the next six months.

- Bullish sentiment declined from 5 per cent the week of October 16 to 37.7 per cent last week (the historic average for bullishness is 37.5 per cent).

- Bearish sentiment increased from 4 per cent to 29.9 per cent (the historic average for bearishness is 31 per cent).

- Neutral sentiment also increased from 2 per cent to 32.4 per cent (the historic average is 31.5 per cent).

Bond investors also have been adjusting their expectations. Since mid-October, the yield on the benchmark 10-year U.S. Treasury note has trended higher. At the start of the month, the 10-year note yielded 3.74 per cent. Last week, its yield rose from 4.07 per cent to 4.23 per cent.

“The rise is likely a reflection of the fact the Federal Reserve will cut interest rates fewer times than investors had thought after September’s Federal Open Market Committee meeting, a result of inflation being above its target and a job market that has grown faster than expected. Also, Donald Trump’s chances of winning the presidential election have risen in the past few months, according to RealClearPolitics. His policies include fiscal spending and tariffs, both of which create inflation and throw cold water on the idea that the Fed will cut rates many times. While the economy could continue to grow, tariffs, for their part, not only lift prices, they destroy demand,” reported Jacob Sonenshine of Barron’s.

Ben Levisohn of Barron’s offered some advice to anyone getting swept up in pre-election jitters. “The truth of the matter is that reading the financial market tea leaves is far from straightforward…In fact, investing with your politics is one of the worst ways to lose money—or miss out on gains.” If you have concerns about market volatility or the possible effect of the election on your portfolio, get in touch. We’re happy to talk with you about your concerns and your portfolio.

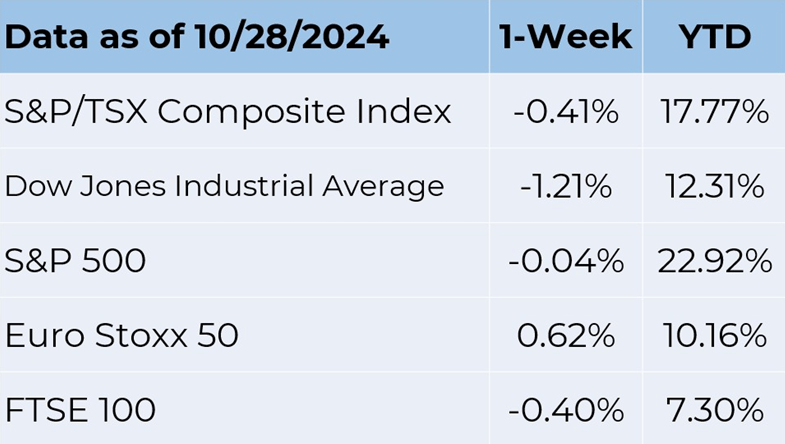

Last week, the S&P 500 Index and Dow Jones Industrial Average moved lower, while the Nasdaq notched a seventh week of gains Yields on longer maturities of U.S. Treasuries moved higher over the week.

Source: FactSet

DO YOU TALK ABOUT MONEY? A lot of important events and holidays are coming up in November. There’s Election Day, National Calzone Day, No-Shave November, the International Day for Tolerance and Talk Money Day.

That’s right! On November 8, everyone is encouraged to put their fears aside and begin talking with other people—spouses, partners, roommates, friends, adult children, and younger children—about money. It’s not going to be easy—money talk is tough for many people. Sixty-two per cent of Americans who participated in a 2023 survey said they did not talk about money. Those who did have financial conversations generally conversed with a spouse or partner, reported Kamaron McNair of CNBC.

There are many reasons people avoid financial conversations. They may:

- Believe it is impolite to talk about

- Worry that discussions will be

- Fear being judged for their

- Think their money is no one else’s

The issue is less prevalent among younger people than it is among older people, according to CNBC. “…56 [per cent] of millennials and 49 [per cent] of Gen Zers say they’re having financial conversations on the regular, compared with just 38 [per cent] of Gen Xers and 22 [per cent] of baby boomers…Talking about money can help young people increase their financial literacy as they learn from and teach their friends. But it’s equally important for younger people to bring up financial topics with their elders—or at least their more experienced peers—especially when it comes to making big decisions,” reported McNair.

While breaking down the money-talk barrier may be challenging, the rewards can be significant. Financial discussions can improve decision- making, strengthen relationships, and help children develop sound money habits. Our goal is to help the people we serve make financial decisions that help them live the lives they want to lead. If talking about money is a difficult hurdle, get in touch. We can help facilitate these important discussions.

Weekly Focus – Think About It

“The single biggest problem in communication is the illusion that it has taken place.”

—George Bernard Shaw, Nobel Prize-winning playwright

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.