Weekly Market Commentary November 14 2024

Canada Economy Under Trump

Canada's living standards have fallen behind the United States in recent years, with Canadians finding it more challenging to meet daily needs than Americans. The claim is built on the fact that the country's economic productivity, as measured by Gross Domestic Product, has been growing slower. World Bank data indicates that the U.S. real GDP data has grown by 60% between 1990 and 2022. In contrast, Canada's GDP has only grown by 43%.

The Canadian economy still needs to do better. GDP per capita has fallen for the past two years, and growth is still slow. Similarly, Canada's economic growth could take a significant hit as Donald Trump prepares to take over, which many economists warn could result in a significant squeeze on several fronts such as trade, immigration, and military spending. Trump's political career has been driven by the idea that the United States needs to be tough with allies who have become overly dependent on it, both militarily and economically.

Few nations are as dependent as Canada, as evidenced by a Washington think-tank report that stated the northern neighbour could be one of the nations most negatively impacted by Trump's proposal for a minimum 10% global tariff.

Three-quarters of Canada's merchandise and two-thirds of its exports go to the U.S. Tariffs pose the greatest threat to this trade activity. Trump has already made it clear that he will impose a 10% fee on all imported products, something that Canada could feel the brunt of as well.

Nevertheless, there is also the prospect of the Canadian economy being the biggest beneficiary of U.S. economic growth under Donald Trump. Being the U.S.'s biggest trading partner, any robust growth in the U.S. is sure to brighten the Canadian economic outlook.

More consumer demand, which includes demand for Canadian goods and services, results from a stronger American economy. Additionally, a lot of companies operate internationally. The technology industry will benefit from loosened regulations under Trump, increasing the number of tech workers employed by U.S. companies in Canada.

The Markets

Stock markets celebrated the results of the presidential election. Bond markets were less enthusiastic.

Last week, United States stock markets rallied, and the U.S. dollar gained against other currencies, following the presidential election. The CBOE Volatility Index, Wall Street’s Fear gauge, also moved lower after concerns about a long wait for election results were quelled by a swift result, reported Alexandra Semenova of Bloomberg.

“…the [stock] markets roared in approval of this Trumpvember surprise… Yes, expect tax cuts, less regulation, fewer guardrails, and a government no longer picking winners and losers (except for tariffs), all reasons why investors perceive the incipient environment to be advantageous. And yet, with all the dancing, dancing, dancing in the streets, note that this new freedom could be accompanied by greater risk in the capital markets,” reported Andy Serwer of Barron’s.

The bond market’s response to the election was measured. The Federal Reserve (Fed) began lowering the federal funds rate in September. Typically, Fed rate cuts lead to lower borrowing costs for consumers and businesses, which supports economic growth. However, the yield on the 10-year U.S. Treasury, which is a benchmark for mortgage rates, corporate bonds, and other loan rates, has trended higher since September, as strong economic data caused the market to rethink its expectations for future rate cuts.

Now, the bond market is evaluating future rate cuts in the context of the new administration’s policies. “…the outlook for further rate cuts has been clouded by expectations that key elements of Trump’s economic platform such as tax cuts and tariffs will lead to faster growth and higher consumer prices. That could make the Fed wary of risking an inflationary rebound by cutting rates too deeply next year,” reported Davide Barbuscia and Lewis Krauskopf of Reuters.

Markets are likely to remain volatile over the coming weeks, as investors speculate about the impact of new policies on financial markets. Last week, major U.S. stock indices surged higher. Yields on U.S. Treasuries were mixed, with yields moving lower on the shortest and longest maturities and rising for other maturities.

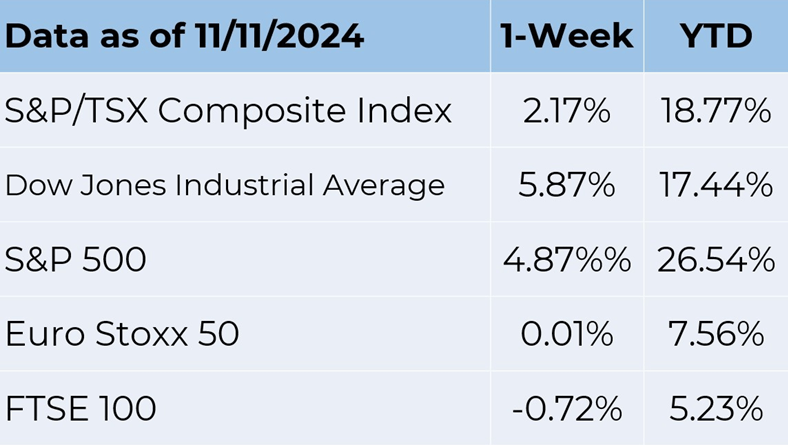

Source: FactSet

Meanwhile, the Canadian stock market was on a roll at the close of business last week, ending two weeks of losses. The rally last week came as the broader stock market benefited from Donald Trump's reelection as investors reacted to his proposal for looser regulation on companies and tax cuts.

Toronto's stock index was up by more than 200 points, rallying to its all-time highs and clocking a 19% year-to-date return. The rally came as the uncertainty that had hit the market came to an end and as optimists focused on how Trump would be suitable for businesses on policies.

Likewise, the rally that started last week persisted at the start of the week, as gains in the overall market were driven by gains in IT, financials, and industrials. According to analysts and strategists, investors in Canadian financial stocks stand to gain from Donald Trump's return to Washington with a plan to reduce taxes and regulations. Even after a 30% increase in the last year, some of them think that Canada's largest banks are still cheap, and they predict that the U.S. economy will continue to grow.

IT’S A DIRTY JOB… If you’re a fan of baseball, you probably know that major league baseball teams don’t use balls that are fresh out of the box. In fact, the Official Baseball Rules for 2024 explains umpires’ pregame duties which include:

“Receive from the home Club a supply of regulation baseballs, the number and make to be certified to the home Club by the Office of the Commissioner. The umpire shall inspect the baseballs and ensure they are regulation baseballs and that they are properly rubbed so that the gloss is removed. The umpire shall be the sole judge of the fitness of the balls to be used in the game.”

Usually, the gloss is removed by rubbing Lena Blackburne Baseball Rubbing Mud into the unused baseballs. “Originally marketed as ‘magic,’ it’s just a little thicker than chocolate pudding—a tiny dab is enough to remove the factory gloss from a new ball without mucking up the seams or getting the cover too filthy. Equipment managers rub it on before every game, allowing pitchers to get a dependable grip,” reported Emma Baccellieri of Sports Illustrated.

The mud is sourced from a secret location, somewhere along a tributary of the Delaware River, has been passed from generation to generation of this family business since the 1930s. The mud is unique because it has “a high clay content in the soil, an oddity for the area, plus brackish water from the tributary mixing with ‘cedar water’ dropping from nearby trees. Perfect conditions exist for only about a mile,” Jim Bintliff told Baccellieri.

Recently, researchers at the University of Pennsylvania School of Engineering and Applied Science and School of Arts & Sciences studied the mud and then published their findings in Proceedings of the National Academy of Sciences. According to ScienceDaily, the paper’s lead author devised three experiments to determine whether mudding baseballs is a superstition, like rally caps and playoff beards, or a value- adding process. The experiments measured the mud’s spread-ability and stickiness, as well as any change in “friction against the fingertips.”

The experiments confirmed baseball players’ long-held belief that magic mud really does improve the performance of baseballs. The substance “spreads like a skin cream and grips like sandpaper,” according to the research.

Weekly Focus – Think About It

“Baseball is 90 per cent mental. The other half is physical.”

—Yogi Berra, baseball legend

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.