Weekly Market Commentary November 21 2024

The Markets

The United States stock market changed course.

Last week, the strength of the United States economy slowed investors’ roll. Federal Reserve (Fed) Chair Jerome Powell told business leaders in Dallas, Texas, that the performance of the United States economy has been “remarkably good,” better than any major economy in the world, which gives the Fed “the ability to approach our decisions carefully.”

Powell’s comments caused investors to reassess the likely pace of rate cuts. As they did, the probability of a December rate cut fell sharply, according to the CME FedWatch Tool.

The likelihood that the Fed may lower rates more slowly than expected roiled markets. Lu Wang, Isabelle Lee, and Emily Graffeo of Bloomberg reported, “With the world’s most important central banker in no hurry to ease monetary policy thanks to a still-robust labour market and strong economic data, bond yields once again rose and dragged stocks lower in their wake. Down 2 per cent over five sessions, the S&P 500 erased half of its trough-to-peak gains since the election. Combined with losses in corporate credit and commodities, the week rounded out a pan-asset retreat that by one measure was the worst in 13 months.”

Investors’ changing outlook was shaped by other factors, too. These included:

- Elevated stock valuations. Bella Albrecht of Morningstar reported, “The U.S. stock market is trading at an 11 per cent premium to its fair value estimate.” The data reflected share prices on November 13, which was midway through last week.

- The risk of inflation rising again. Many economists believe the incoming administration’s spending and tax policies have the potential to reignite inflation, which could lead the Fed to reassess monetary policy.

- A disrupting cabinet nomination. Robert F. Kennedy Jr. to lead the Department of Health and Human Services rattled healthcare and consumer staples sectors of the market. “Shares of biotechnology and pharmaceutical companies fell, with the S&P 500 Pharmaceuticals index down about 2 per cent. Shares of packaged food and beverage giants…also declined,” reported Samuel Indyk and Ludwig Burger of Reuters.

By the end of the week, major U.S. stock indices were down. U.S. bond markets continued to be wary of tariffs and inflation, lifting the yield on the benchmark 10-year U.S. Treasury to 4.5 per cent. By week’s end, though, the 10-year Treasury yield had settled at 4.3 per cent, reported Liz Capo McCormick of Bloomberg.

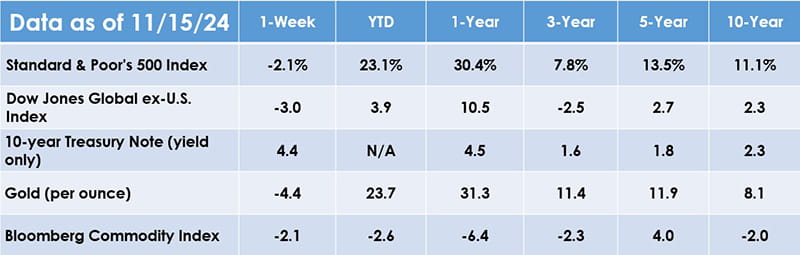

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

THANKSGIVING ABUNDANCE. Turkey, mashed potatoes, and cranberrysauce have been on the Thanksgiving table for a long time. In manyhomes, though, the holiday meal has evolved to include regional dishes,cultural treats, and family favourites. People who responded to a socialmedia post asking about unique Thanksgiving dishes reported that theirmeals include:

- Sliced tomatoes, cucumbers, olives, and onions with oil and vinegar,

- Chorizo cornbread with jalapeños,

- Sashimi and grilled salmon collar,

- Cranberries, grapes, walnuts and whipped cream salad,

- Quinoa with roasted delicata squash, kale, and pistachios,

- Creamed pearl onions,

- Spinach casserole,

- Twice baked potatoes,

- Shrimp and mirlitons (pear-shaped squash), and many other dishes.

Another reason Thanksgiving meals have evolved is dietary preferences.Some families include one or more vegetarian or vegan members, andothers are eating less meat for health reasons.

Of course, grocery stores have played a significant role in the evolution of Thanksgiving dinner. “The average grocery store today has 300,000+ itemsin stock, nearly eight times more than the average store of the 1970s,”reported Andy Nelson in Supermarket Perimeter. Having access to a widervariety of ingredients makes it possible to prepare holiday feasts that makeyour taste buds happy.

What is your family’s favourite Thanksgiving dish?

Weekly Focus – Think About It

“The first Thanksgiving meal in Plymouth probably had little in common withtoday’s traditional holiday spread. Although turkeys were indigenous, there’s no record of a big roasted bird at the feast. The Wampanoag brought deer and there would have been lots of local seafood (mussels, lobster, bass) plus the fruits of the pilgrim harvest, including pumpkin. No mashed potatoes, though. Potatoes had only recently been shipped back to Europe from South America.”

—Origins of Thanksgiving National Holiday, History.com

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.