Weekly Market Commentary December 5 2024

Canada Economy Slowdown

The Canadian economy remains on edge heading into the New Year. While the economy did grow in the third quarter, the rate of growth is already raising serious concerns. Data from Statistics Canada shows that the economy expanded by 1.5% from June to September. The second quarter saw a significant drop from the 2.2% growth.

The 1.5% growth also undershot the Bank of Canada expectations, which had already been revised from an earlier forecast of 2.8%. With a 0.4% decrease in real GDP per capita during the quarter, growth per capita has now slowed for six straight quarters.

According to Statistics Canada, consumer spending has increased, especially on new SUVs, vans, and trucks. In the third quarter, spending increased at all governmental levels as well. Additionally, households were saving more money overall, even though consumer spending was credited with keeping the economy afloat during that time. In the third quarter, the net household savings rate increased as disposable income increased by 2.3%, almost twice as fast as spending, which increased by 1.2%.

Since June, the Bank of Canada has lowered its policy rate by 1.25 percentage points. Its priorities have changed from controlling price pressures to boosting the economy and preventing inflation from falling below 2%.

The slow growth comes at a time when consumer spending has shown signs of improving amid the recent interest rate cut spree. Nevertheless, it is at a time when the economy is at risk of being hit with tariffs by the incoming administration. Donald Trump has already warned that Canadian imports could be subject to 25% tariffs once he assumes office in January.

Although the proposed tariffs are only threats, such a move would significantly impact the Canadian economy, which is highly dependent on the US export market. Expectations are high that the Canadian economy will recover with 2% GDP growth in 2025, assuming the tariffs are not enacted.

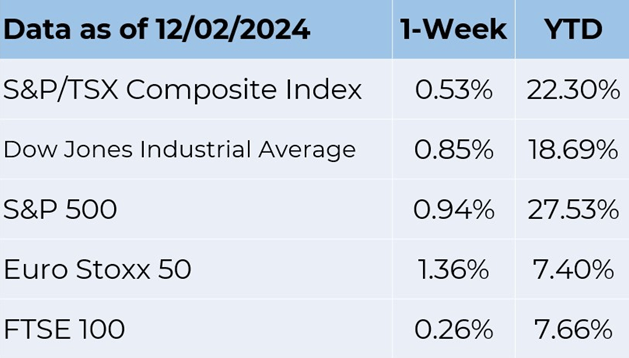

Meanwhile, investors continue to shrug off a standoff between Canada and the US. Equity markets remained upbeat, with the Toronto Stock Exchange posting consecutive weekly gains fueled by gains in the technology and real estate sectors. The TSX was up by 203 points to end the week at highs of 25,648.

The Markets

Not one, but two!

United States stock markets are serving another cup of cheer this year. The Standard & Poor’s (S&P) 500 Index returned more than 24 percent in 2023.This year, it was up 26.5 percent through the end of November.

It’s possible 2024 will end up in Wall Street’s bull market hall of fame, wrote Jan-Patrick Barnert of Bloomberg, because the year-to-date return of the S&P 500 ranks among its best performances of this century.

“Not many expected another blistering rally fueled by a handful of tech titans and market sentiment so bullish that one risk event after another got cleared without a scratch… Market swings were benign, with only one big valley of tears: a summer pullback that culminated in a small selloff around early August. The drop lasted for just less than a month and failed to cross the threshold of 10 [percent], typically seen as a correction.”

On a relative basis, U.S. stock markets have significantly outperformed stock markets elsewhere. Consider the performance of a few non-U.S. indexes through Thanksgiving.

| Index Name(thru Nov. 28, 2024 | Year-to-date return |

| MSCI Europe | 0.98 percent |

| MSCI Europe, Australia, and the Far East (EAFE) |

2.95 percent |

| MSCI Emerging Markets (EM) | 5.46 percent |

| MSCI Japan | 6.14 percent |

| MSCI China | 12.91 percent |

| MSCI India | 13.54 percent |

Over the year, the number of U.S. stocks participating in the rally rose. “The rally is broadening out…more stocks are advancing than declining.

Typically, that phenomenon bodes well for the entire stock market. It’s a sign of better market breadth, meaning that the major indexes aren’t being led by just a small handful of stocks,” reported Paul R. La Monica of Barron’s.

However, La Monica also cautioned against becoming complacent: “… given how long it has been since Wall Street has faced any significant obstacle, it isn’t entirely clear what might happen if market or economic conditions suddenly head south.”

Last week, stocks jolted up and down as investors responded to data about political appointments, tariffs, and inflation data. By the end of the week, major U.S. indices were higher. Treasury bonds gained, too, as yields moved lower after president-elect Donald Trump nominated hedge-fund billionaire Scott Bessent to be U.S. Treasury Secretary. Many believe Bessent could be a moderating influence when it comes to taxes, tariffs, and the deficit, reported Mitchell Hartman of Marketplace.

Source: FactSet

THERE ARE A LOT OF QUESTIONS ABOUT TARIFFS. Last week, president-elect Donald Trump took to social media, promising to increase tariffs on China, Mexico, and Canada. One result was that internet searches

related to the term “tariffs” increased sharply. These searches included:8

- How do tariffs work?

- What is Trump’s tariff plan?

- Things to buy before tariffs

- Tariffs for dummies

Here are a few answers to common questions about tariffs:

What are tariffs? Tariffs are a form of tax that one country assesses on materials, parts, and products imported from another country.

What do tariffs do? In theory, raising prices on foreign goods will protect

U.S. companies and jobs by encouraging Americans to buy goods that are produced in the United States. It doesn’t always work that way because the country the U.S. imposes tariffs on is likely to respond in kind, adding tariffs to U.S. materials, parts, and products. A study of the 2018-19 trade war between the U.S., China, and other nations found:

“The trade war has not to date provided economic help to the U.S. heartland: import tariffs on foreign goods neither raised nor lowered U.S. employment in newly protected sectors; retaliatory tariffs had clear negative employment impacts, primarily in agriculture; and these harms were only partly mitigated by compensatory U.S. agricultural subsidies.”

Who pays for tariffs? The cost of a tariff is paid by U.S. businesses and U.S. consumers. “The importer who brings the product into the country—be it a car or an avocado—is responsible for the tariff at the port of entry.

Customs officials collect the tax, and the money goes to the U.S. Treasury. The importer can pass the cost of the tariff along in the form of higher prices to the consumer. Or, in some cases, the manufacturer or importer may choose to absorb some or all of the cost, taking a hit to the bottom line,” reported Tim Smart of U.S. News & World Report.

How much will tariffs raise prices? After the president-elect announced his tariff intentions, Barron’s estimated “that a 10 [percent] tariff could raise the cost of a new car in the U.S. by 4 [percent] or 5 [percent] without any adjustments from automakers. That was based [on] imports and where parts and cars are manufactured in North America. A 25 [percent] tariff on Canada and Mexico implies the price jump would be closer to 8 [percent],” reported Al Root of Barron’s.

When countries fight by raising tariffs, it’s called a trade war.

Weekly Focus – Think About It

“It is difficult to make predictions, especially about the future.”

—Karl Kristian Steincke, Danish politician

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.