Weekly Market Commentary December 12, 2024

The Markets

Canadian investors have everything to cheer about heading into year- end and the holiday season. The Canadian stock market has been making record highs for the better part of the year. Likewise, the bond markets still offer favourable yields despite the Bank of Canada cutting interest rates to steer the economy into a soft landing.

Underpinning the strong performance in the equity markets is the fact that the Canadian economy continues to grow at or above the trend. With no signs of recessions on the horizon, there is everything to cheer about, given the upward momentum in the equity markets. While the economy did come under pressure, the gross domestic product expanded by 0.3% in the third quarter after rising by 0.5% in the first and second quarters. Slower non-farm inventory accumulation, lower business capital investment, and lower exports offset the GDP growth gains from increased government and household spending.

A resilient job market is further evidence that the Canadian economy is doing much better. The total jobs added were about 51,000 in November, more than double the 25,000 jobs that analysts expected. While the unemployment rate ticked higher to 6.8%, it remains much below the

long-term average of about 8%. The labour market continues to normalize after a period of outsized strength, post the pandemic.

Heading into 2025, the Canadian economy will have to navigate a string of challenges. Top on the list is the uncertainty around policy changes with the administration change in the U.S. President-elect Donald Trump has already indicated he could hit Canada with 25% tariffs as one of the protectionist measures aimed at protecting U.S. manufacturers.

Likewise, the Canadian economy might face uncertainty around the central bank's rate-cutting policy. Should growth remain robust and the risk of inflation crop up, the rate-cutting cycle, which has offered much- needed support, might be shallower than expected.

On the other hand, Canada’s main stock index, the Toronto Stock Exchange, remains at record highs despite losing ground at the start of trading on Monday. The index remains supported above the 25,600 level after gaining 22% year to date. The rally to record highs comes from strong technology and essential material sector gains.

Expectations that the Bank of Canada will continue its easing cycle are another factor fueling the buying spree in the equity markets.

Nevertheless, headwinds in the U.S. are increasingly rattling investor sentiments, triggering minor pullbacks from record highs.

U.S. Stocks Thrive Amid Turmoil

The performance of the U.S. stock market is striking. Last week, the Standard & Poor’s (S&P) 500 closed at a record high for the 57th time this year, reported Rita Nazareth of Bloomberg. Here are some of the notable factors that sent stocks higher last week:

Political upheaval overseas. A declaration and cancellation of martial law in South Korea and the toppling of the French government roiled financial markets overseas, making United States markets attractive. “The political chaos spanning Seoul to Paris this week is reinforcing why many investors have chosen to stick to American markets,” reported Simon Kennedy and Phil Serafino of Bloomberg.

A powerful technology rally. Spending and excitement around the potential of artificial intelligence (AI) continue to delight investors. Both the communication services and information technology sectors are expected to report double-digit earnings growth during the last three months of 2024, reported John Butters of FactSet.

Rising company profits have been driven by higher spending. “While the ROI [return on investment] of any given AI project remains uncertain, one thing is becoming clear: CIOs [chief investment officers] will be spending a whole lot more on the technology in the years ahead. Research firm IDC projects worldwide spending on technology to support AI strategies will reach $337 billion in 2025—and more than double to $749 billion by 2028,” reported Paula Rooney of CIO.

Continued U.S. economic strength. Employers added 227,000 new jobs in November. That was well above the 200,000 forecasted, reported Barron’s. Stocks rose on the news, and so did expectations that the Federal Reserve will lower interest rates again at its December meeting. Lower rates are typically good for companies because they often lower the cost of borrowing and lead to higher spending.

By the end of the week, the S&P 500 and Nasdaq Composite indexes were higher. The Dow Jones Industrial Average finished lower as it has less exposure to technology stocks, according to Barron’s, and more significant exposure to a large health insurance company that saw its stock price fall sharply after the assassination of its chief executive officer last week, reported Caroline Valetkevitch of Reuters. Treasury bonds gained last week, too, as yields moved lower on expectations of a Fed rate cut.

When any asset class experiences significant gains during the year, it’s important to review your investment allocations and make adjustments to maintain the risk profile that makes you most comfortable. Rebalancing also helps investors follow an important investment strategy: buy low and sell high.

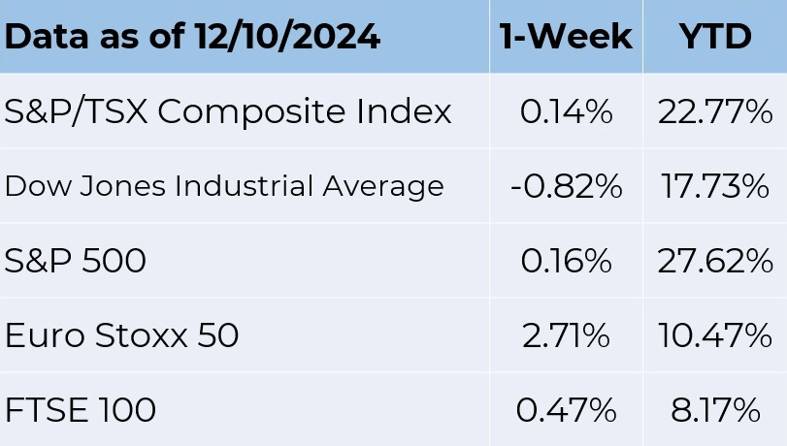

Source: FactSet

‘TIS THE SEASON FOR CYBERCRIME. While scammers and cybercriminals are always on the take, people tend to be particularly vulnerable to fraud amid the whirlwind of winter holiday shopping, giving, and travel. In a recent survey, 82% of participants reported they had experienced online scams from “encountering a deceptive advertisement to receiving a fake shipment notice or request from a fraudulent charity,” according to Jennifer Sauer of AARP Research.

During 2023, losses from internet crime totaled $12.5 billion. It’s a staggering sum—and may wildly underrepresent the actual amount taken. The FBI’s 2023 Internet Crime Report stated, “…when the FBI recently infiltrated the Hive ransomware group’s infrastructure, we found that only about 20 [%] of Hive’s victims reported to law enforcement.”

Common 2024 Holiday Scams

In 2024, cybercriminals have become more aggressive and more devious, according to the FBI. The top schemes this holiday season include scammers:

- Posting websites and social media ads offering goods at unusually low prices,

- Soliciting donations for fake charities,

- Encouraging “investment” through phony cryptocurrency platforms,

- Selling fake gift cards to be used for donations or time-sensitive purchases, and

- Offering fake gift cards and event tickets on social media to steal personal data.

Here’s how to protect yourself

Being aware of the risks is the first step toward protecting yourself from cybercrime. The FBI and Lars Daniel of Forbes offered tips for protecting yourself this holiday season.12,13 They include: s

- Resist temptation. Do not click on links received via e-mail, text, or messaging apps. If you receive a communication that a delivery has been delayed or there was an issue with a payment or something else has happened, don’t click on the link provided. Go to the company’s website or app to check.

- Verify before sharing, donating, or paying. If you receive a communication from a charity or financial institution you know, take time to verify the contact is truly from the organization. Cybercriminals can fake real numbers on caller ID and send messages that lead you to fake websites. One way to verify is to contact the organization directly with a phone number or email found on its official website, an account statement, or the back of a credit or debit card.

- Be wary of urgent requests. Holidays are often pressure-filled. Scammers often create a false sense of urgency, encouraging people to act without thinking carefully. Before you respond to an urgent and unexpected request, take time to think, research, and verify. Also, remember that government and law enforcement agencies will never ask that payments be made over the phone, via email, or through gift card purchases.

Any time you’re asked to share personal information, think carefully about who is asking and whether they should have the information. If you have any questions about how to protect yourself this holiday season, please get in touch.

Weekly Focus – Think About It

“We are all now connected by the Internet, like neurons in a giant brain.”

—Stephen Hawking, physicist and cosmologist

Best regards,

Eric Muir

B.Comm (Hons. Finance), CIM®, FCSI

Senior Portfolio Manager

Derek Lacroix

BBA, CIM®, CFP®

Associate Portfolio Manager

P.S. Please feel free to forward this commentary to family, friends or colleagues. If you would like us to add them to the list, please reply to this email with their email address and we will ask for their permission to be added.

Disclaimer:

Information in this article is from sources believed to be reliable, however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Eric Muir and Derek Lacroix and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.